As Bitcoin’s price got a hit, traders foresee much deeper corrections could be ahead, setting new targets in the low $40,000 range.

What Bitcoin recovery? Market sentiment is cloudy.

During early Asian trading hours on August 5, Bitcoin fell below the $50,000 mark, and has dropped nearly 31% over the last three days.

Once in 7-10 years event, as they say. Analysts are divided on whether BTC will see a fast recovery or there will be more pain.

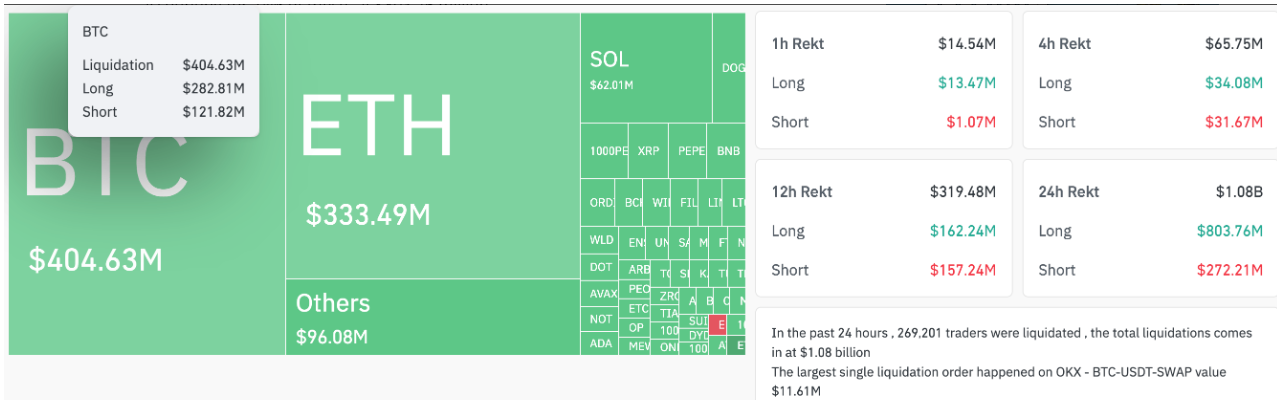

Massive liquidations, $1 billion gone

Bitcoin’s decline below $50,000 led to more than $500 billion being wiped out of the crypto market in just 24 hours, with numerous leveraged positions being liquidated.

The total amount is way bigger, approximately $1.08 billion in leveraged positions were liquidated across derivatives markets, with long positions accounting for 74% of these, totaling $803.76 million.

In the same period, Bitcoin positions worth over $404.63 million were liquidated, with $282.81 million of these being long liquidations.

The current correction in Bitcoin’s price is influenced by several factors, including weak economic and job data from the US.

Michael van de Poppe, founder of MN Capital, shared that the ongoing price drop could either mark the cycle’s bottom or signal the start of a major crisis.

He posits that a V-shaped recovery could occur, leading Bitcoin to quickly rebound and possibly retest the $70,000 level.

The relative strength index being in the oversold region at 28 hints that the downward momentum might soon end.

Hello $40,000 my old friend!

Traders and analysts are now speculating on how low Bitcoin might go before a trend reversal. And the numbers aren’t looks good.

CryptoQuant founder Ki Young Ju has set a lower target within the $45,000 to $55,000 zone, noting that this range represents the cost basis for mining companies and Binance traders.

If Bitcoin’s price falls below this level, it could confirm a temporary bear market, just like in November 2018, March 2020, and May 2022.

Polymarket traders are betting on a continued decline, with a 45% chance that Bitcoin will fall below $45,000 before the end of the month.

This sentiment rose to 65% during early European trading hours amid numerous liquidations.

Bitcoin analyst Tuur Demeester observed BTC trading just above $51,000, mentioning that the $45,000 to $40,000 range could serve as a technical downside target for the cryptocurrency.