Denmark is kicking the hornet’s nest in the crypto world with a new proposal. The country’s Tax Law Council has put forward a recommendation to tax unrealized gains on cryptocurrency assets.

Best thing to do in Denmark: Leave.

Yes, you heard that right—if this goes through, you might be taxed on your crypto profits even if you haven’t sold a single coin.

The council explained that their goal is to clear up the confusion around how gains and losses are taxed.

This means that if you hold onto your Bitcoin or Ethereum and they increase in value, you could still owe taxes based on that increase, whether you’ve cashed out or not. They call it mark to market taxation.

So, what does “mark-to-market” taxation mean? It’s a fancy term for taxing the yearly changes in the value of certain assets.

The council noted that this kind of taxation is treated as capital income and would apply continuously, regardless of whether you actually sell your crypto.

If you would report your clients’ activity, that would be awesome.

The challenge with taxing crypto comes from its wild nature, because it’s not like stocks or bonds that have a centralized authority keeping tabs on them.

The council acknowledged this difficulty and stated that they want to introduce these new tax rules no earlier than January 1, 2026.

At the start of 2025, Denmark’s Minister of Taxation plans to roll out a bill that includes these recommendations.

This bill will likely require crypto service providers to report details about their clients’ transactions. So, if you thought your crypto dealings were private, think again!

Are you okay, Denmark? Idiocracy supposed to be a satire, not a guide!

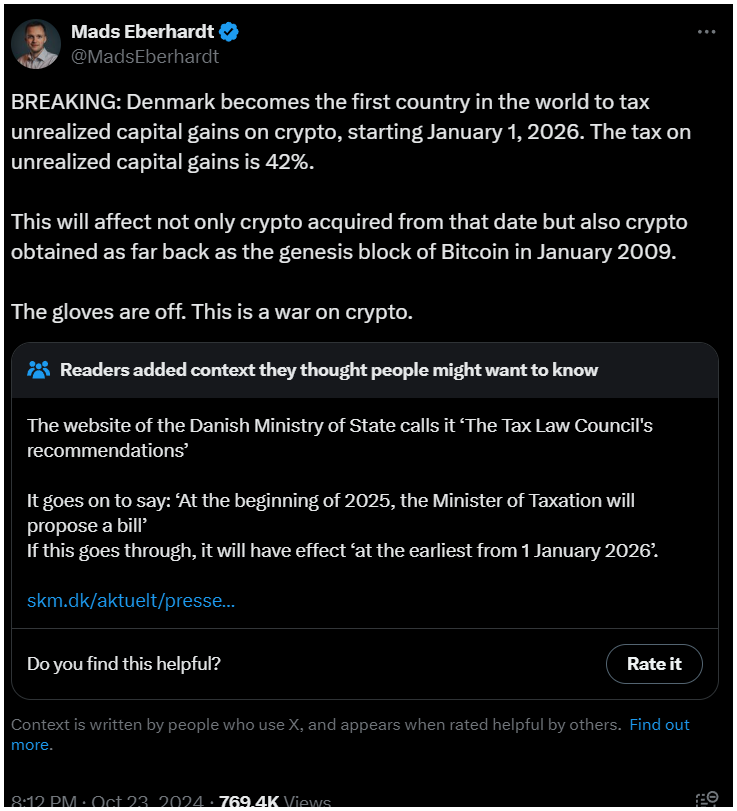

Mads Eberhardt, a senior crypto analyst at Steno Research, weighed in on this development on X. He estimated that the tax on unrealized gains could be around 42%.

Yikes! That means it wouldn’t just affect new investments, it could al

so reach back to any Bitcoin you bought way back when it first launched in January 2009. Eberhardt didn’t hold back, saying, “The gloves are off. This is a war on crypto.”