A crypto analyst made a pretty bold prediction that Bitcoin’s price could skyrocket to $233,000 by the first quarter of 2025.

This forecast is based on a key technical indicator suggesting that Bitcoin’s current period of consolidation might lead to a giant price surge, the long awaited omega candle.

Technical analysis over all

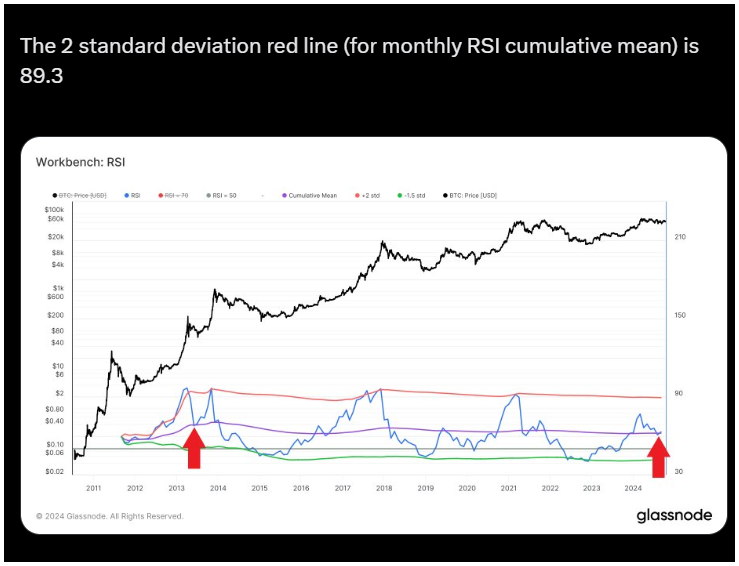

The analyst known in the sociall media as Bitcoindata21 pointed out a historical link between peaks in Bitcoin’s RSI and its price increases.

The RSI is a technical tool used to measure the strength or weakness of an asset based on its recent price changes, and by comparing today’s RSI levels with those from previous bull markets, the analyst believes that hitting a price target of $233,000 or even higher is quite possible by early next year.

While this prediction might sound ambitious, or crazy, it’s not completely out of the blue.

Bitcoin has a history of experiencing rapid price increases during bull markets, often triggered by supply shocks following halving events. T

he last halving occurred in April of this year, so everything is set.

Hot weekend

As of now, Bitcoin is trading at around $69,000 after making nice gains over the past week.

CryptoQuant’s data shows that Bitcoin reserves on exchanges also dropped to an all-time low of 2.6 million BTC, down from more than 3.3 million BTC nearly three years ago.

The Bitcoin network remains active with high transaction volumes and increased address usage as long-term holders continue to accumulate more coins. On the other hand, short-term holders are starting to show signs of selling.

Fewer Bitcoin reserves on exchanges could mean that the available supply is shrinking, and if demand stays steady or even rises, this could push prices higher.

Decreasing Bitcoin supply

Another factor contributing to this price movement could be the announcement from the trustee managing Mt. Gox’s assets, which revealed a delay in distributing remaining funds to creditors. Again.

This deadline has now been pushed back by a year to October 31, 2025.

Moreover, supply may have also decreased because the Bitcoin staking protocol Babylon recently reopened for new BTC deposits.

It already attracted about $1.5 billion worth of Bitcoin within just an hour and a half as investors who forgot the ’not your keys, not your coins’ saying are rushed to stake their coins.