The Tron network hit a new revenue milestone, thanks in large part to its memecoin launchpad, SunPump.

Nearly one-third of Tron’s impressive quarterly revenue of $151.2 million came from this new platform during a two-week period.

Memecoin activity

Tron’s SunPump has been a game changer, driving the blockchain’s revenue up by nearly 30% compared to the previous quarter.

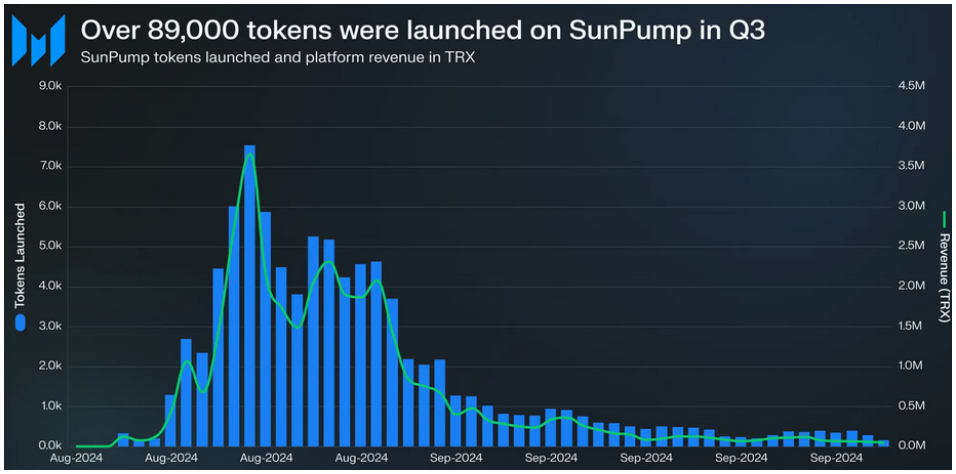

Between August 12 and September 30, over 89,000 tokens were launched on SunPump, leading to a freakin’ 487% increase in decentralized finance transactions on the Tron network during Q3.

Messari reported that activity on SunPump really took off starting August 16 and reached a peak in just two weeks.

During that time, more than 270 million TRON tokens were burned, generating about $42 million, which accounted for nearly 27% of Tron’s total revenue for the quarter.

The excitement peaked on August 20 when a record-breaking 7,500 new SunPump tokens launched in a single day.

Then on August 21, the amount of TRX burned was higher than any other day in the network’s history.

But as with all good things, the fun didn’t last forever, and by September, the number of new tokens being launched on SunPump dropped to under 1,000 per day.

Memecoins, the crazy force behind market dynamics

Among the memecoins launched, SunDog stands out with a market cap of $217 million.

Other tokens like Tron Bull and Invest Zone, and of course, their early holders have also enjoyed substantial trading volumes.

By the end of Q3, TRX’s circulating market cap grew for the seventh consecutive quarter, rising by 24% to reach $13.5 billion.

At one point during the SunPump hype, it even skyrocketed to $14.5 billion.

Fundamentals are unchanged

Tron also maintained its deflationary status in Q3 with a net burn of 587.6 million tokens.

The average daily transaction count increased by 14.4%, reaching 7.2 million transactions per day, while the number of active addresses rose by 6% to 2.1 million.

Despite this growth, the total value locked in Tron’s decentralized finance protocols fell from $8.1 billion at the end of Q3 to $6.98 billion.

Tron’s TVL is now down by 32.8% from its all-time high of $10.4 billion reached in March, but on the other hand, the market cap for USDT on Tron saw a slight increase of 3% during the quarter, bringing it close to $59 billion and accounting for about half of USDT’s total market cap across all supported chains.