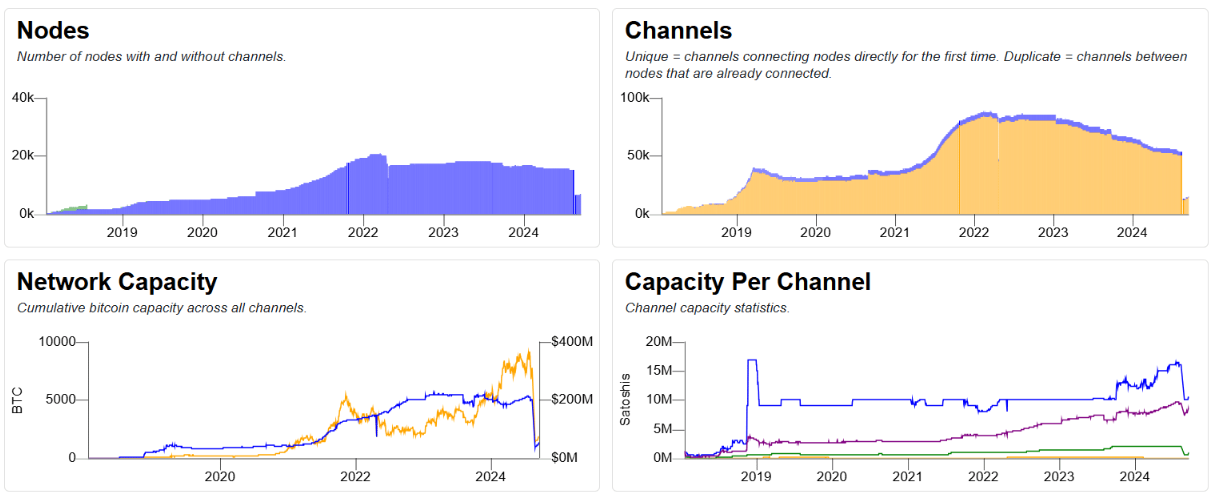

The capacity of the Lightning Network declined from 5,308 BTC in July to just 1,273 BTC at now.

Bitcoin gained huge adoption this year, especially with the launch of ETFs, but it seems to be losing ground in the payments sector.

Lightning Network usage in downtrend

The Lightning Network is a layer 2 protocol designed to enable fast, secure, and low-cost transactions on the Bitcoin network.

If we take a look at the data from Bitcoin Visuals, we can see that activity on the Lightning Network just fallen back to levels not seen since 2021.

The number of nodes and channels also dropped, suggesting there are way fewer users engaging with the network.

Not surprisingly, this decline sparked discussion within the Bitcoin community. Some, like the well-known Bitcoiner Sylvain Saurel, pointed fingers at MicroStrategy’s Michael Saylor.

Saurel argues that Saylor’s repeated statements claiming that using Bitcoin as a means of exchange is a distraction have contributed to the growing disinterest in the Lightning Network.

Positive developments everywhere

In a huge development, Louisiana has begun allowing residents to pay for state services using Bitcoin through the Lightning Network.

Louisiana State Treasurer John Fleming stated that this decision aligns with their plans to adopt new technologies.

Lightning Network is somehow a niche within the Bitcoin industry, because it’s not too big yet, and when a state starts using it, that’s a big deal.

“By introducing cryptocurrency as a payment option, we’re not just innovating; we’re providing our citizens with flexibility and freedom in interacting with state services.”

Former President Donald Trump also made headlines by becoming the first U.S. President to make a purchase using Bitcoin, because he bought cheeseburgers at a Bitcoin-themed PubKey bar in New York City using BTC.

Progress isn’t linear, things are changing gradually then suddenly

The slowdown in Lightning Network usage is visible, but the overall strength of the Bitcoin network appears to be improving.

Monthly active addresses steadily increasing no matter how prices are fluctuating, recently reaching 10.7 million.

This growth is a quite positive sign for the network’s health. But also experts warn that it’s possible that this rise in active addresses is linked to trading activity rather than actual usage of the network for transactions.