On-chain data shows a bigger increase in the number of whales on the XRP network. Many experts say this signaling a bullish trend for the asset’s price. When Moon?

Whale alert

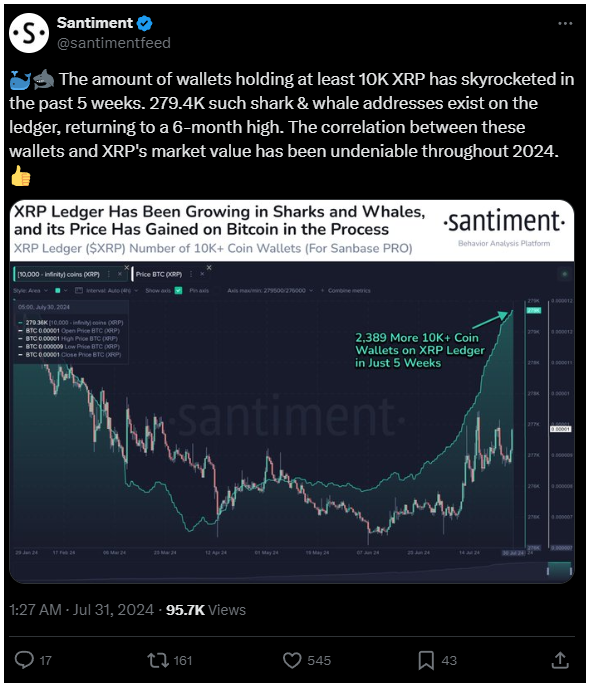

Santiment’s latest publication shows, the number of shark and whale wallets has surged over the past five weeks.

The Supply Distribution indicator, which tracks the number of addresses in different wallet groups based on their coin holdings, shows this rise.

For instance, addresses with 1 to 10 XRP fall into the 1 to 10 coins group.

The group of interest here holds 10,000 or more coins, called as sharks, equivalent to about $6,500 at current prices.

This group includes the biggest investors too, called whales, whose activities can influence the market.

Big players influencing the XRP market

Sharks and whales are key market players, with whales being more influential due to their larger holdings.

The number of addresses in this group grew big, with about 2,390 new addresses emerging in the past five weeks.

This suggests that sharks and whales have been accumulating XRP, likely in anticipation for higher prices.

The indicator has now reached 279,400, the highest level in about six months.

Earlier this year, the indicator showed a downtrend, which coincided with a bearish phase for XRP’s price.

The indicator bottomed out in April, around the time the asset’s decline began to slow. Since the recent increase in shark and whale activity, XRP’s price has also started to rise again.

Santiment notes, the correlation between these wallets and XRP’s market value has been undeniable throughout 2024.

The skyrocketing phase of XRP is just around the corner

But we’re waiting for this corner for years, as there wasn’t any skyrocketing for a long time.

Given the established patterns now, experts say it will be important to monitor this indicator in the near future. If the trend continues, it could bring a bullish outcome for XRP. Finally.