As Bitcoin continues to rallying, the classic tug-of-war between bullish market sentiment and selling pressure from miners is back in the spotlight.

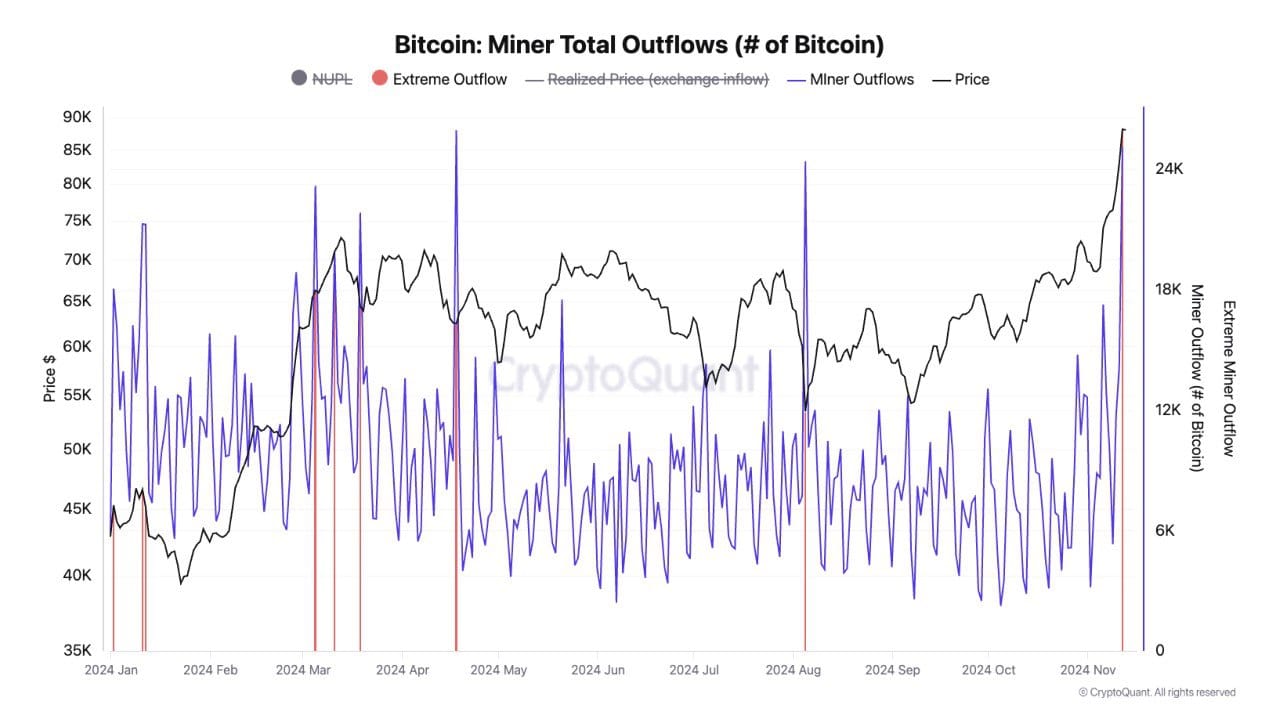

After hitting an ATH of $93,000, miners have been offloading their holdings to cover operational costs or lock in profits.

The miners’ dilemma

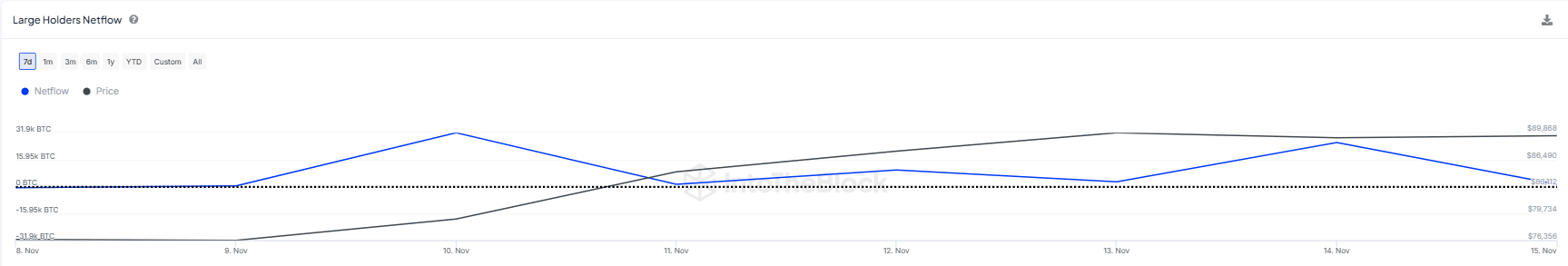

In the past few days, Bitcoin dipped to around $86,000, thanks to some of this miner selling.

But don’t count the bulls out just yet, because they quickly rallied again, pushing BTC back up to around $91,000 in the time of writing.

Bitcoin holders and miners are at a bit of a crossroads, should they sell now or hold on for the long haul?

It’s a tricky situation since BTC is currently in a ‘high risk’ zone, where even a slight shift could send panic rippling through the market. Especially when you have bills to pay. So miners are facing their own set of challenges.

The last halving cut miner rewards down to 3.125 BTC, making it tougher for them to cover expenses and secure profits.

Consequently, miners’ reserves are at an all-time low, with daily outflows following patterns seen during previous market peaks.

Miners’ reserve isn’t infinite…

If miners keep selling off their holdings every time Bitcoin hits a new high, like it has three times in less than ten trading days, this could delay its rise above $93K and jeopardize any chance of a parabolic run toward $100K.

On the other hand, Tether’s treasury has started printing new USDT tokens again, thanks to an influx of investors coming to Bitcoin post-election.

This uptick signals rising demand and boosts liquidity in the market, and more liquidity means more Bitcoin available for trading.

Of course, if retail investors find a better buying opportunity than $91K, the pressure will shift back to institutional investors and large holders.

Fresh incentives needed for growth

It’s no secret that the crypto market often thrives on game theory, and sometimes speculation.

Bulls are banking on potential future developments, even if they’re not set in stone yet.

For example, the idea of the U.S. building a reserve of Bitcoin is still just a concept but remains a key factor keeping bullish sentiment alive.

Other factors fueling this optimism include hopes that the U.S. will become a major crypto hub, rising FOMO, anticipated Fed rate cuts next month, and billions flowing into ETFs.

These elements have helped prevent Bitcoin from taking a major nosedive, though it did dip to $86K due to miner selling

While minor corrections are part of the game as weaker hands get shaken out, consistent fresh incentives are essential for Bitcoin’s long-term growth.

If bulls can stay strong, BTC might just push toward that new ATH again.