Binance Coin is once again trading at the highs it reached over the past ten weeks. The early release of former Binance CEO CZ from jail was expected to spark excitement in the market.

While it did create some buzz on social media, the price action didn’t follow suit yet.

BNB price range

BNB is moving within a range that has lasted nearly three months, with prices fluctuating between $464 and $604.

The mid-range level of $535 also acted as both support and resistance, making the traders annoyed and nervous with such a sideway crabbing.

Back in mid-September, BNB tested this level as support before climbing 12.7% to hit the range highs again.

What does the technical indicators say?

The daily RSI now is still above neutral at 50, which usually indicates bullish momentum, but there’s a catch.

It’s showing a bearish divergence. This means that while the price is going up, the RSI is making lower highs, suggesting that a pullback might be on the way.

On top of that, the On-Balance Volume hasn’t been able to reach the highs from July. This situation mirrors what happened in mid-August when BNB faced a strong rejection at around $600.

All these technical signals suggest that a rejection from the current highs is more likely than a breakout.

Liquidation is coming?

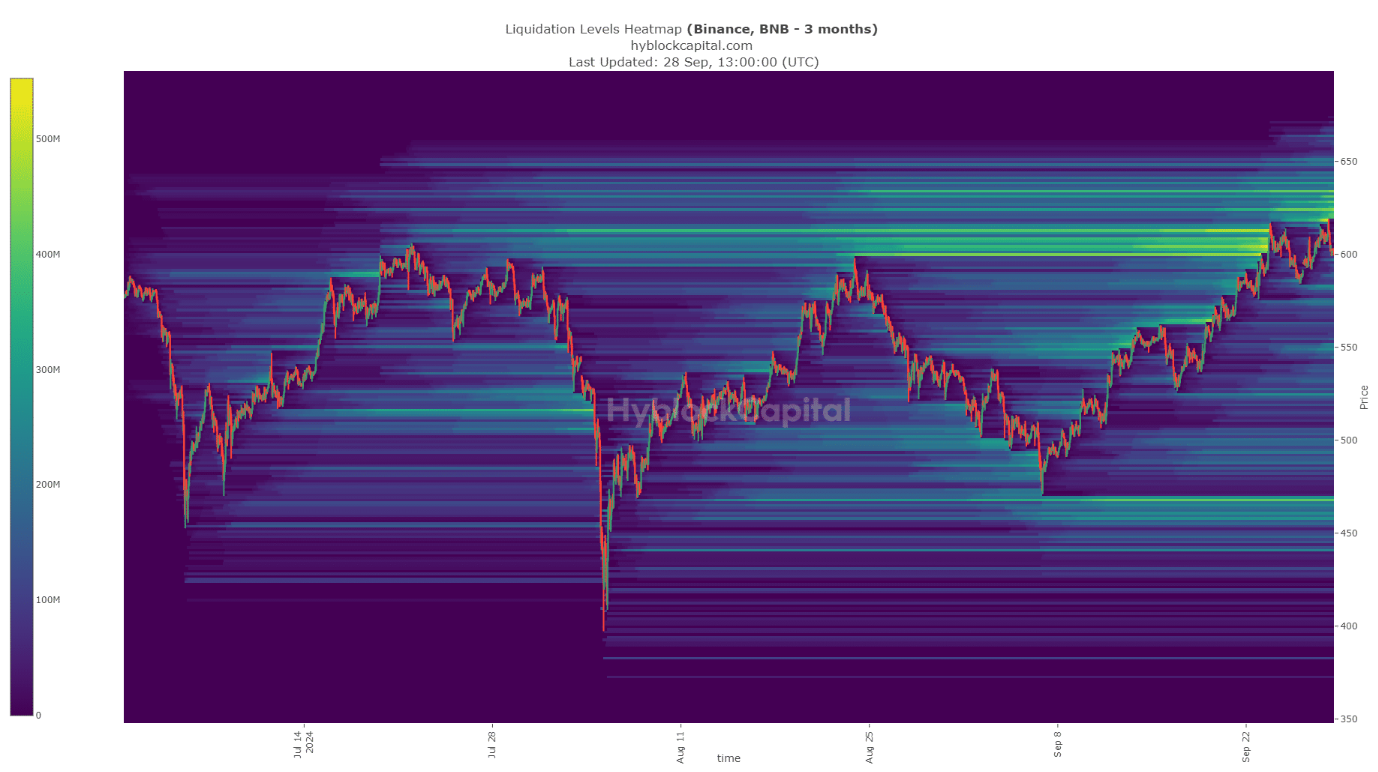

The three-month liquidation heatmap shows that the price zone between $621 and $635 could act like a magnet for BNB.

Before this, the $600 to $614 area attracted prices before they pulled back to around $585.

There’s also a chance that BNB could experience a false breakout past these highs to reach $635 before pulling back again.

Simply put, we have exactly zero clue how the price will going. Or we’ll get a short squeeze, then a long squeeze, and everyone will be liquidated to the oblivion.

Traders should be ready to take profits as BNB approaches these levels and wait for a potential pullback to find better buying opportunities.