Federal Reserve rate cuts would boost Bitcoin prices in theory, but former BitMEX CEO Arthur Hayes suggests that the opposite might be happening due to other financial factors.

Where is the Bitcoin price rise?

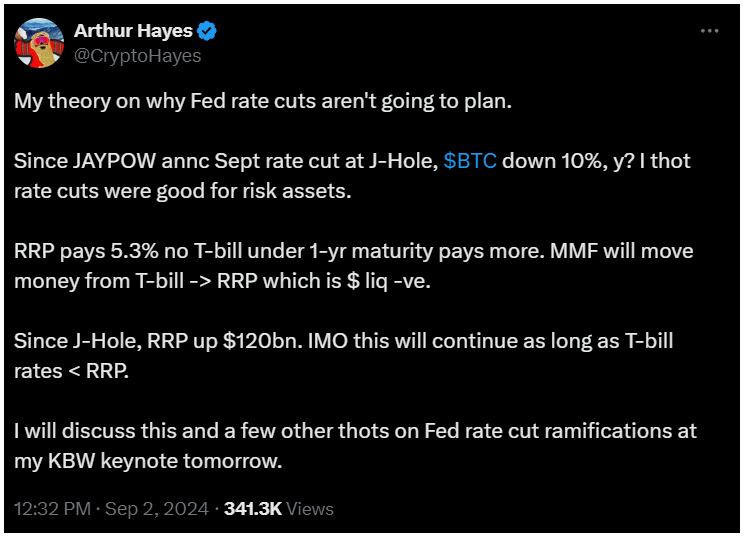

The founder and former CEO of BitMEX, Arthur Hayes shared his thoughts on why the anticipated interest rate cuts by the U.S. Federal Reserve may not be benefiting Bitcoin as many had hoped.

Hayes discussed how Bitcoin prices have actually dropped since Federal Reserve Chair Jerome Powell hinted at a rate cut during his speech at Jackson Hole on August 23.

Following the speech, Bitcoin saw a pretty short rise to $64,000 before quickly falling by 10% to a low of $57,400 by September 2.

Reverse repos, the name of the game

Hayes pointed to reverse repurchase agreements, the RRPs as a key reason behind Bitcoin’s poor performance. RRPs involve the sale of securities with an agreement to buy them back at a higher price later.

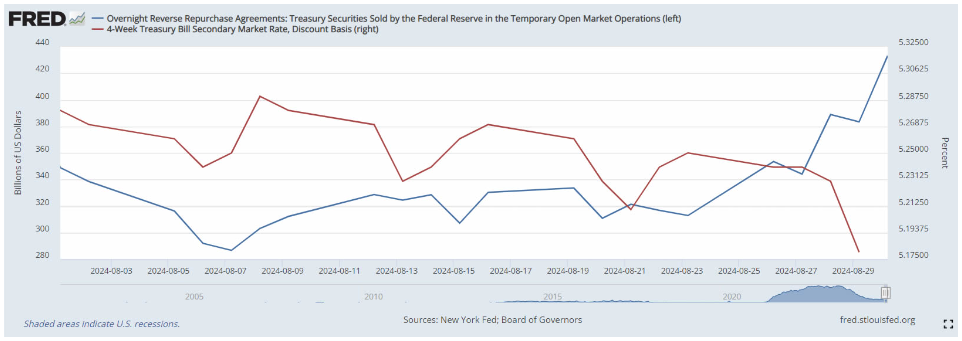

These agreements now are offering a 5.3% interest rate, which is more attractive than the 4.38% yield on Treasury bills, a common short-term government debt instrument, and this higher return is causing large money market funds to move their cash from Treasury bills into RRPs.

Thus, there is less liquidity available for riskier assets like Bitcoin.

Some also clarified that the RRP program acts like a parking lot for big banks and money managers, allowing them to earn higher interest on their cash without risking it in the market.

This means that instead of money flowing into the economy and potentially boosting assets like Bitcoin, it’s being parked in these safer, but higher-yielding investments.

Rate cut, liquidity up, but Bitcoin flat?

Hayes highlighted that this trend pretty much contradicts the common belief that lower interest rates are beneficial for high-risk assets like Bitcoin.

Typically, lower rates are expected to encourage borrowing and spending, which should increase liquidity in the market.

This would make low-yield savings accounts less attractive, pushing investors toward riskier assets.

Next to this, the weaker dollar might make Bitcoin look more appealing. But RRPs are act now as alternatives.

Based on the numbers of CME Fed Watch tool, there’s a 69% chance of a 25 basis point rate cut and a 31% chance of a 50 basis point cut at the Federal Reserve’s next meeting on September 18.