Bitcoin miners are continuing to sell their assets under growing pressure, but analysts say a major sell-off hasn’t happened yet.

This selling isn’t that selling

Bitcoin miners are facing higher pressure as the hashrate slows, operating costs rise, and the price of Bitcoin falls. Hits from three direction.

James Check, the well-known analyst looked into the miner sell pressure to understand how severe the situation is.

In a video from last week, Check explained that it’s common for miners to sell more after a halving event, which reduces their block rewards.

Smaller rewards, less revenue, less profit, but the costs usually growing. Guess what? They have to sell.

The worst is yet to come?

Check examined the so-called Puell Multiple, which compares the daily issuance value of bitcoin to the 365-day moving average.

This showed that miners aren’t at extreme stress levels but aren’t comfortable either. I wouldn’t be a miner now.

If the market drops more, and it likely will, miners could reach a point of capitulation, the infamous miner capitulation, what means they have to sell off their holdings quickly. It’s a red day for the market.

He also noted a hash ribbon inversion, which occurs when the 30-day moving average of the hashrate falls below the 60-day moving average, indicating tough times for weaker miners who may have to shut down older, less efficient, unprofitable machines.

The overall hashrate has only dropped by 4%, which is less than in previous times of miner stress, which means it could be drop more, way more, as it’s not a full-scale liquidation yet.

The market is changing

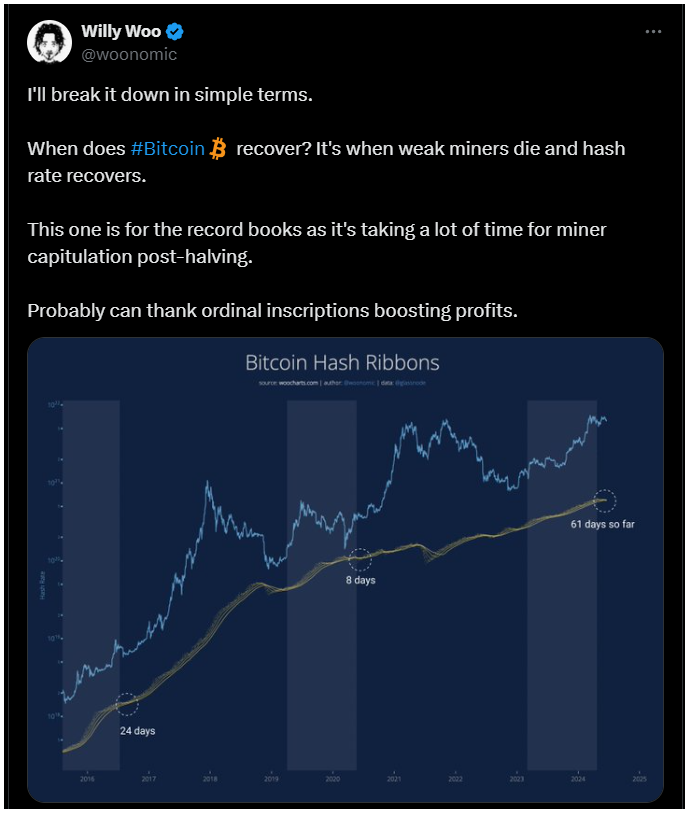

Check concluded that it doesn’t feel like a severe bear market capitulation now. Analyst Willy Woo mentioned on X that Bitcoin will recover once weaker miners exit and the hashrate stabilizes.

Woo noted that this miner capitulation is taking longer than usual post-halving and that ordinal inscriptions, with their higher fees are likely helping miners stay afloat.