Bitcoin’s price is relatively stagnant in the past days, showing only a slight increase.

After a big downturn in global financial markets, Bitcoin rebounded strongly over the past week, gaining 16% and reaching a peak of $62,000.

Bullish breakout is coming, but only if key price level holds

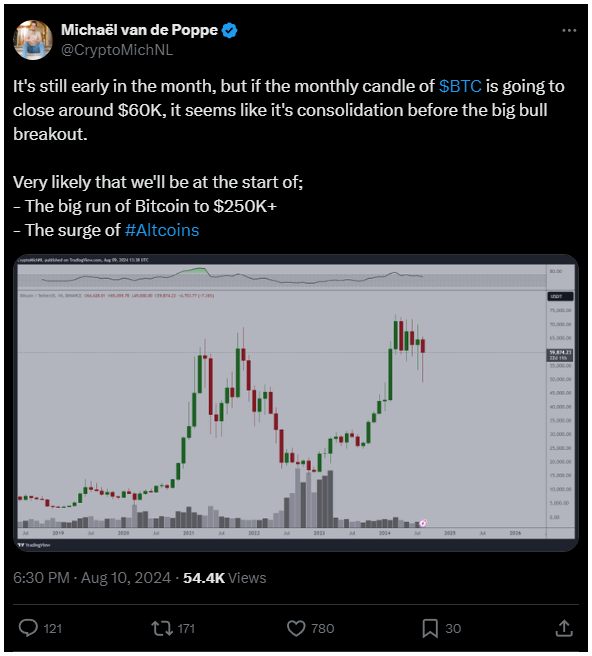

On August 10, the famous analyst and trader Michale van de Poppe shared his views on Bitcoin’s price movement in a post on X, suggesting that if Bitcoin closes its monthly candle around the $60,000 mark, it could be a clear signal that the cryptocurrency is consolidating for a breakout.

The analyst believes that such consolidation could set the stage for a massive bullish run, driving Bitcoin’s price to an ambitious target of $250,000. Ookay, let’s see how!

Investors and market experts have been waiting a bullish jump in Bitcoin’s price following the April halving event, a phenomenon historically associated with quite significant price increases.

But this doesn’t happened, Bitcoin has remained in a tight trading range between $55,000 and $70,000 over the past four months.

But as van de Poppe predicts, Bitcoin’s historical trends suggest its bull run begin approximately six months after a halving event.

This market is not that market anymore

The current market cycle could be described by high levels of optimism, with multiple analysts forecasting six-figure price targets for Bitcoin.

This is not a big surprise, especially after the introduction of Bitcoin spot ETFs, which have already reached a combined value of multi billion dollars.

From magic internet money to the hall of power

The digital asset industry also made an unexpected entry into the U.S. political landscape, with cryptocurrency policies becoming a key issue in the upcoming November elections, also likely because the authorities gave green lights for many spot Bitcoin ETFs in January.

This political focus could lead to increased regulatory support and legitimacy for the cryptocurrency sector, which in turn might boost Bitcoin’s performance over the next years.