The crypto market has been feeling a bit down lately, but hold onto your hats because two key factors could spark a year-end surge that even Santa would approve of.

Trading volumes on fire

First off, let’s talk about trading volumes, because the crypto scene has been quieter than a library during the holiday season, which is pretty typical this time of year, but low trading volumes could actually set the stage for a price rally.

Santiment thinks that when trading activity slows down like now, it gives whales a chance to swoop in and accumulate assets without causing too much fuss.

And yes, these whales have been on a bit of a shopping spree, not just for Bitcoin but also for speculative alts.

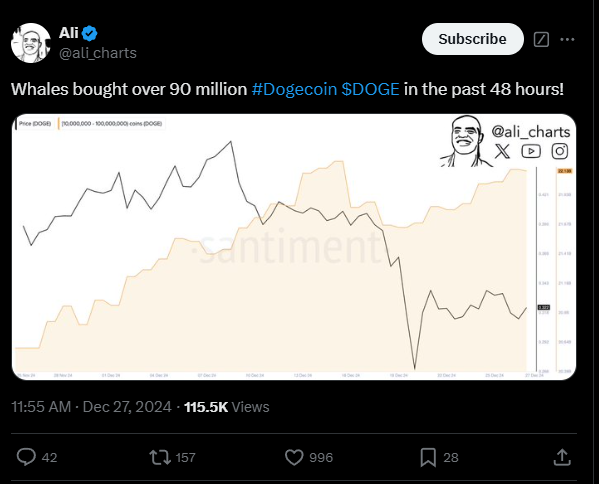

This is good news for memecoins like Dogecoin, which could see some action if these big players keep buying.

In fact, on-chain data from Ali Martinez shows that Dogecoin whales have been snapping up more of the coin during this dip.

Stablecoins must flow

Now let’s shift gears to stablecoins, especially because Binance has seen a massive influx of these assets lately.

We’re talking about $29 billion in USDT and USDC flowing into the platform.

This is quite a big deal because stablecoins act as a bridge between fiat and crypto, making it easier for traders and institutions to navigate the often bumpy waters of crypto trading.

Purchasing power

CryptoQuant highlights that this growing reserve of stablecoins is a bullish sign for the market, and it suggests that traders are gearing up to buy more BTC or alts as we head into 2025.

With stablecoins providing liquidity and stability during volatile periods, this could mean good things ahead for crypto prices.