The NFT market is flooded with wash trading, a practice where traders create fake trades to inflate trading volumes.

Renowned NFT expert Andrew Forte recently shed light on this issue, showing how artificial, pumped trading volumes can mislead investors and users, probably leading to financial losses.

Numbers from leading NFT platforms reveal the true scale of this phenomenon.

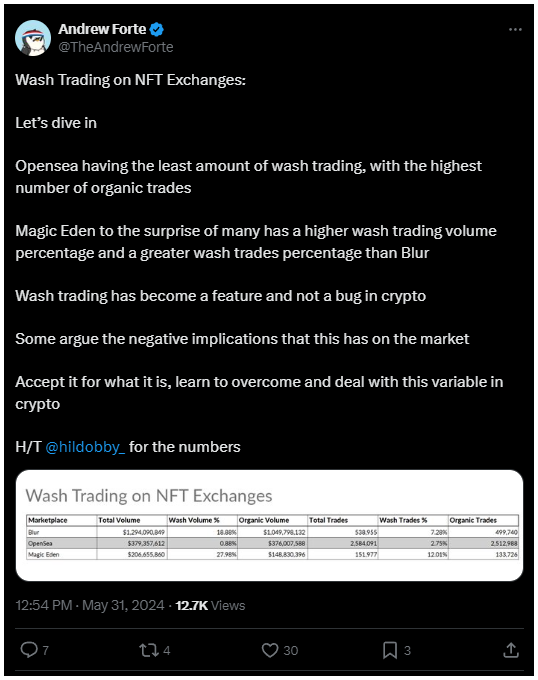

Wash trading everywhere

According to the data, Blur and Magic Eden are highly affected by wash trading.

Blur has an overall volume of $1.29 billion, with 19% attributed to wash trading, resulting in a genuine volume of $1.05 billion, while Magic Eden’s total volume stands at $206.66 million, with 28% linked to wash trading, leaving an authentic volume of $148.83 million.

In contrast, OpenSea, the OG NFT marketplace shows the lowest level of wash trading at 0.88%, maintaining a healthy, organic trading volume of $376 million out of a total of $379 million.

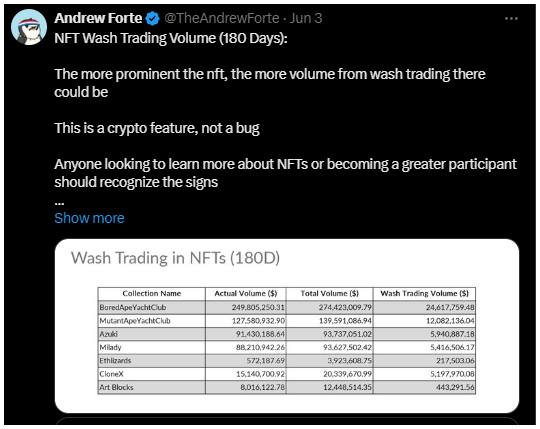

Not every collection are equal

The rate of wash trading varies significantly across different NFT collections.

For example, the Bored Ape Yacht Club has the highest actual volume at $249.81 million, with $24.62 million stemming from wash trading, and the Mutant Ape Yacht Club follows with a volume of $127.58 million, including $12.08 million from wash trading.

Both have to deal with roughly 10% of fake trading volume. Other collections such as Azuki, Milady, and Ethlizards exhibit lower levels of wash trading.

There will be signs

Recognizing the signs of wash trading may be a good step for traders, and there are numerous examples what we can monitor.

Indicators include stable prices despite high-priced buys, low social media interaction coupled with high trading activities, and multiple trades involving the same buyer within a short time frame.

Also, when a single address engaging in frequent trading of a specific NFT often signals potential wash trading.

Wash trading remains a significant issue in the NFT market, so investors must stay aware and educate themselves on catching red flags and understanding market dynamics to make well-informed decisions.