Solana has seen a price increase of over 12% in the past week, following the filing of spot Solana exchange-traded funds by VanEck, a major American investment management company.

The price of SOL rose from $134 on June 27th to $151 the next day, before settling slightly lower.

One ETF, two ETF…

VanEck’s ETF filing was soon followed by a similar filing from 21Shares, another crypto-focused financial firm based in Switzerland.

According to Kaiko Research, these ETF filings supported the positive market sentiment, which had been affected by worries over potential large-scale selloffs due to repayments from the Mt. Gox bankruptcy.

Market is happy, but not euphoric

Kaiko’s researchers noted that the ETF filings led to a smaller boost in market sentiment.

They reported that SOL’s cumulative volume delta, the CVD indicator, which measures net buying and selling, showed a positive net of $29 million over the past week.

Data shared by Kaiko revealed a surge in spot buying on Coinbase over the weekend.

How it started, and how it will going?

Kaiko pointed out that while the ETF filings initially lifted the market mood, their overall impact was limited.

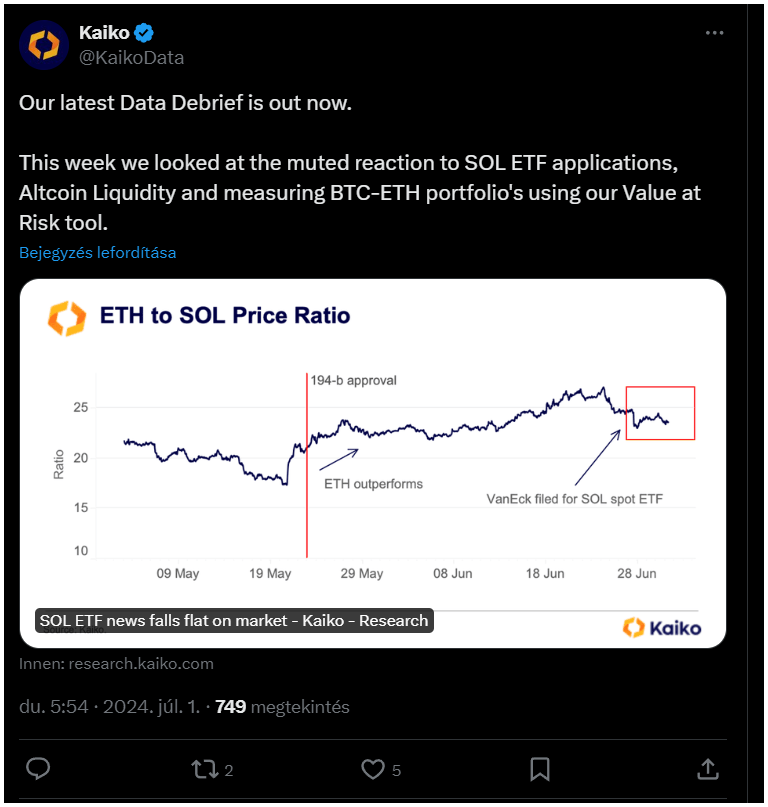

They compared this situation to March, when asset management firms filed for spot Ethereum ETFs.

At that time, the ETH to SOL ratio fell, indicating that SOL outperformed ETH, but after U.S. regulators approved the Ethereum ETFs, this trend reversed, and the ratio has remained stable, showing no reaction to the recent SOL ETF filings.

Kaiko also observed that the impact of the SOL ETF news was mainly confined to the spot markets, with the reaction in the derivative markets being short-lived.

This contrasts with the more sustained response in the spot markets.