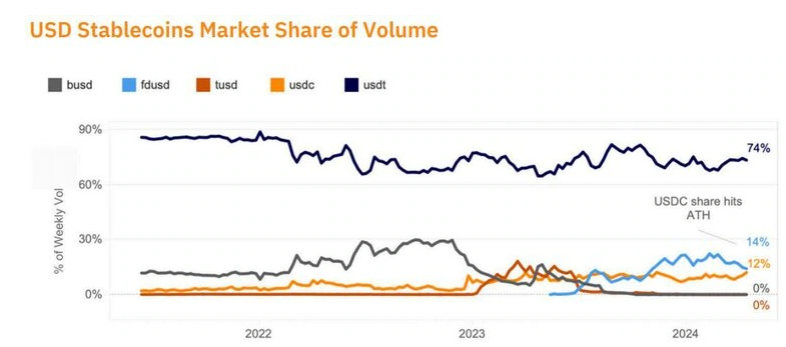

USDT’s market share on centralized exchanges has fallen from 82% to 74% in 2024. This may looks small, but in reality it’s multibillion dollar decline.

Declining share for Tether

Despite high-profile collapses and events in the last years causing de-pegging, the demand for stablecoins remained still strong.

Even though stablecoins continue to take market share from traditional fiat, Tether’s USDT has seen a decline in its dominance over the past two years.

According to the latest data from Kaiko, USDT’s market share on centralized exchanges dropped from 82% to 74% in 2024.

One cause behind this is likely the competition from other stablecoins like FDUSD, which gained popularity through Binance’s zero-fee promotions, and also the rising demand for regulated options like USDC.

USDC on fire

By the end of June, USDC’s market share hit a record high of 12%, thanks to the trading on platforms like Binance, Bybit, and OKX.

Yield-bearing stablecoins have also attracted more interest, with issuers like Paxos and Tether introducing their own yield-bearing options to meet this growing demand from the customers and traders.

The new European MiCA regulation also further increased the demand for compliant stablecoins, positioning Circle’s USDC as a key player, and a winner player in the EU markets.

Obey the law

Currently, non-compliant stablecoins make up 88% of the total stablecoin volume. But this is expected to change significantly with the introduction of the Markets in Crypto-Assets Regulation, the MiCA in Europe, started from June 30.

This regulation is likely to make market makers favor compliant stablecoins over non-compliant ones.

In response, major crypto exchanges like Binance, Bitstamp, Kraken, and OKX already started delisting non-compliant stablecoins, including USDT, for European users. Kaiko’s data shows that the share of compliant stablecoins is growing over the past year.