Former President Donald Trump is pulling out all the stops to win over voters.

While he’s had his fair share of criticisms about cryptocurrencies—labeling Bitcoin as “not money” and “highly volatile”—he hasn’t completely turned his back on digital assets.

Trmp’s shift toward crypto

Trump’s interest in NFTs has been pretty evident since he launched his first series of digital collectibles back in December 2022. This move showed that he’s got a keen eye on this asset class.

In the days, he took to X to celebrate the 16th anniversary of Bitcoin’s white paper, receiving ixed reactions from the crypto community.

“I would like to wish our great Bitcoiners a Happy 16th Anniversary of Satoshi’s White Paper. We will end Kamala’s war on crypto, & Bitcoin will be MADE IN THE USA! VOTE TRUMP!”

Reactions to Trump’s comments have been mixed. Some in the crypto community praised him for his proactive stance, but not everyone is on board with his approach.

Erik Voorhees, CEO of ShapeShift, expressed some skepticism about Trump’s newfound love for Bitcoin. His opinion is not totally unexpected, let me say this.

Polls and market movements

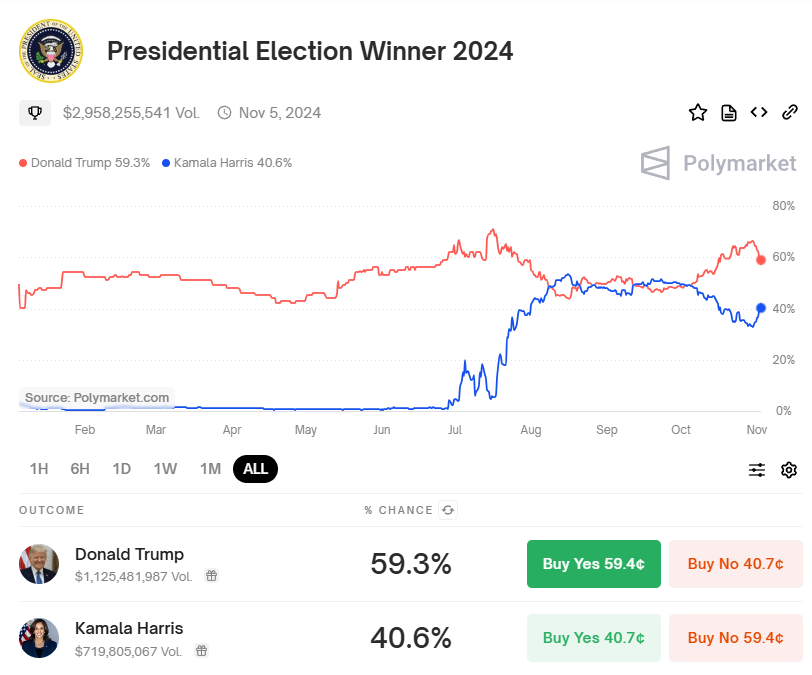

On the Polymarket, Trump has garnered 59.3% support among bettors compared to Harris’s 40.6%.

Cryptocurrency has become a pretty hot topic this election cycle. A relatively new study by Consensys and HarrisX found that nearly half of registered voters consider a candidate’s pro-crypto stance important when making their voting decisions.

Among crypto owners, this interest is even stronger: 92% plan to vote, and 85% prioritize crypto as a key issue.

Comparing approaches

This growing interest has prompted Trump to actively engage with crypto supporters, positioning himself as a pro-Bitcoin candidate.

He even attended the Bitcoin Conference 2024 despite facing security threats and launched Bitcoin-themed sneakers along with a fourth series of NFT trading cards.

In contrast, Harris made quite limited outreach efforts with her “Crypto for Harris” campaign and a pro-blockchain speech at The Economic Club of Pittsburgh. Many says it’s not enough for gaining any real trust from crypto users.