Trump tariffs have triggered new discussions about Bitcoin revaluation as global markets face a $10 trillion equity rout.

Financial markets reacted sharply in recent weeks after U.S. President Donald Trump’s aggressive tariff measures came into effect.

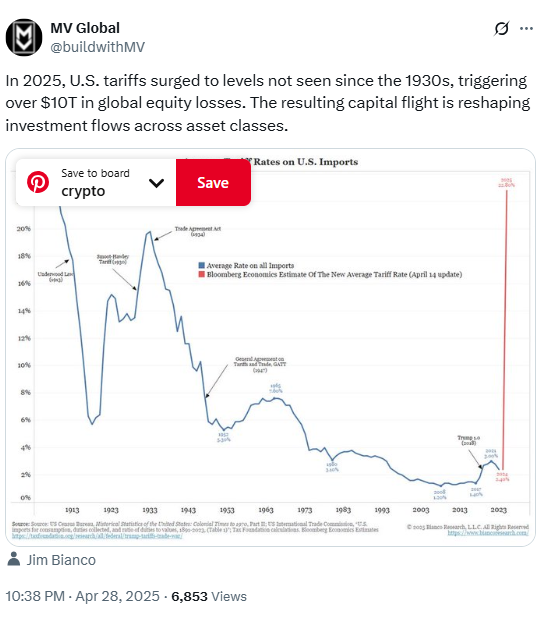

Bitcoin experienced notable volatility during this period, with investors shifting strategies amid growing uncertainty. MV Global reported that the United States’ average tariff rates in 2025 reached highs not seen since the 1930s.

According to MV Global, “The resulting capital flight is reshaping investment flows across asset classes.”

This statement underlined Bitcoin’s growing presence in conversations about alternative stores of value.

Global Liquidity Recovery Drives Bitcoin Revaluation Debate

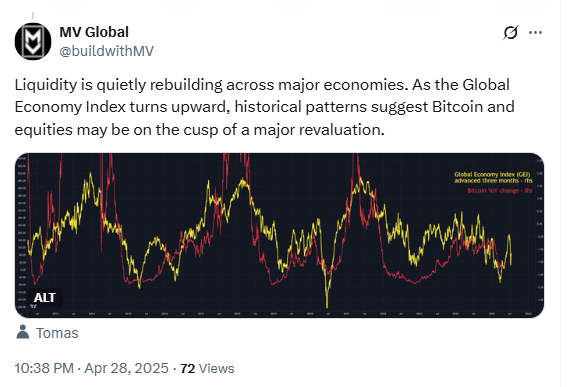

Liquidity conditions across major economies are quietly improving, according to MV Global’s latest Global Economy Index.

This index tracks cross-border capital flows and monetary trends, offering early signals about market behavior.

MV Global noted,

“Liquidity is quietly rebuilding across major economies. As the Global Economy Index turns upward, historical patterns suggest Bitcoin and equities may be on the cusp of a major revaluation.”

Bitcoin’s position in these forecasts ties directly to previous periods of broad market shifts.

Analysts studying Bitcoin revaluation trends point to strong connections between liquidity expansion and asset price increases.

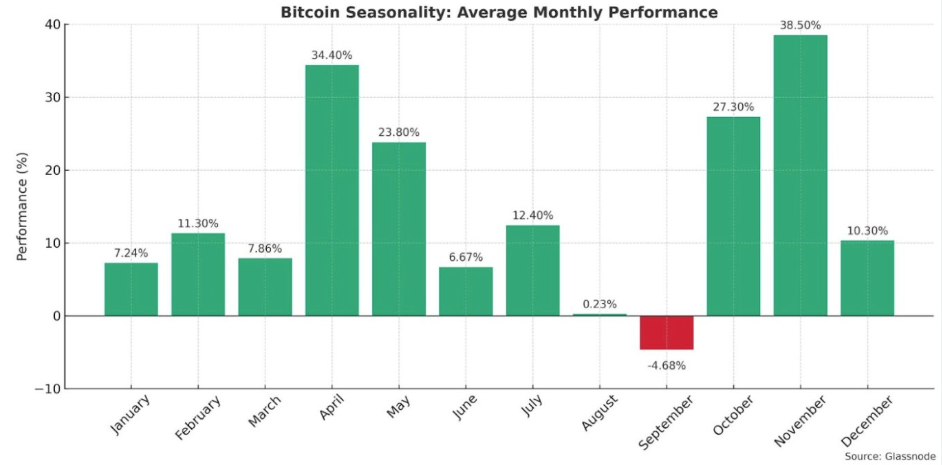

In April, Bitcoin demonstrated seasonal strength once again. Data from Glassnode shows Bitcoin has historically recorded an average return of more than 34.4% in April, often during periods of financial turbulence.

Bitcoin Seasonality Aligns With Current Market Instability

Glassnode data reveals Bitcoin’s April seasonality remains a consistent pattern, especially when financial markets show signs of stress.

Bitcoin’s past performance during April reflects its ability to maintain momentum during instability.

The $10 trillion equity rout coincided with Bitcoin’s seasonal rise, highlighting its potential role during times of capital flight.

Analysts studying Bitcoin revaluation emphasize the importance of this repeated behavior.

The connection between Trump tariffs and Bitcoin’s seasonal strength has become clearer, with rising trade tensions pushing investors toward decentralized alternatives.

Bitcoin Volatility Now Resembles Major Equity Indexes

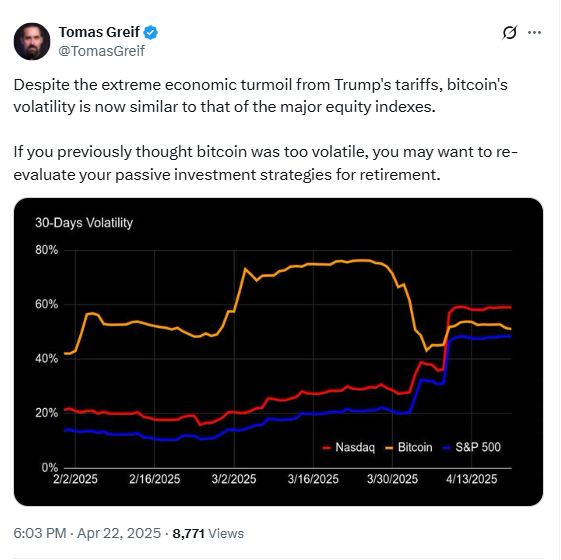

Tomas Greif, Chief of Product Strategy at Braiins Mining Ecosystem, pointed out the changing nature of Bitcoin volatility. He explained that Bitcoin’s fluctuations are becoming more similar to those seen in traditional equity markets.

“If you previously thought Bitcoin was too volatile, you may want to re-evaluate your passive investment strategies for retirement,”

Greif said in a statement on X.

Greif also shared a chart comparing Bitcoin volatility to equity indices. His data showed the narrowing gap between Bitcoin’s price movements and traditional market swings, strengthening Bitcoin’s growing association with mainstream financial assets.

Bitcoin’s Role as a Monetary Hedge Gains Attention

Mathew Sigel, Head of Digital Assets Research at VanEck, emphasized Bitcoin’s shifting role in financial systems under pressure.

He stated,

“Bitcoin is evolving from a speculative asset into a functional monetary tool—particularly in economies looking to bypass the dollar and reduce exposure to US-led financial systems.”

Sigel’s comments reflect how Trump tariffs, capital flight, and the $10 trillion equity rout have pushed Bitcoin closer to being recognized as a monetary hedge.

Bitcoin’s resilience during the $10 trillion equity rout and the ongoing Trump tariffs supports its positioning as a potential decentralized monetary option.

With liquidity trends shifting and Bitcoin revaluation debates intensifying, Bitcoin’s broader role in global finance remains a subject of close observation.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.