TORN just surged by 400% following a federal appeals court ruling against the U.S. Treasury’s sanctions on the crypto mixing service.

Court ruling shakes things up

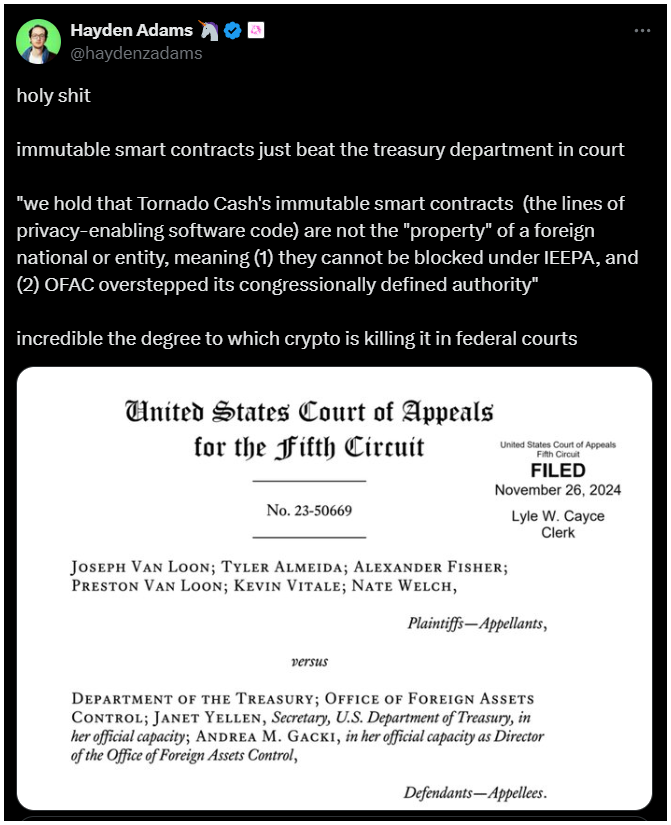

On November 26, the Court of Appeals in New Orleans decided that the Treasury Department overstepped its bounds by sanctioning Tornado Cash as a software rather than targeting specific individuals or entities.

The three-judge panel agreed that the code behind Tornado Cash cannot be treated as property that can be sanctioned.

Judge Don Willett acknowledged that while the government’s concerns about foreign actors laundering money through crypto mixers are undeniably legitimate, federal law only allows the Treasury to act against property.

He suggested that perhaps Congress should update laws from the Carter Administration to better address modern technologies like crypto-mixing software.

“Until then, we hold that Tornado Cash’s immutable smart contracts are not the ‘property’ of a foreign national or entity, meaning they cannot be blocked.”

Support from Coinbase

Coinbase was a key player in this legal challenge, arguing against the blanket ban on open-source technology.

The Department of the Treasury’s Office of Foreign Assets Control, the OFAC originally sanctioned Tornado Cash in 2022, claiming it was used to launder over $7 billion in cryptocurrency, including $455 million linked to North Korean hacking groups.

Uniswap founder Hayden Adams couldn’t contain his excitement after the court’s decision.

“It’s incredible how crypto is killing it in federal courts!”

And he’s not alone. Coinbase’s chief legal officer Paul Grewal celebrated what he called a historic win for crypto and all who care about defending liberty, and emphasized that these smart contracts should be removed from the sanctions list, allowing U.S. users to access this privacy-protecting protocol once again.

Privacy wins. Today the Fifth Circuit held that @USTreasury’s sanctions against Tornado Cash smart contracts are unlawful. This is a historic win for crypto and all who cares about defending liberty. @coinbase is proud to have helped lead this important challenge. 1/6

— paulgrewal.eth (@iampaulgrewal) November 26, 2024

“No one wants criminals using crypto protocols, but blocking open-source technology entirely because a small portion of users are bad actors is not what Congress authorized.”

TORN price takes off

Following the court’s decision, TORN’s price first skyrocketed by more than 850%, jumping from $3.60 to $35 in early trading in Asia.

Although it has since dipped to around $18, that’s still an incredible increase of over 400% within just 24 hours.

On the other hand, it’s worth noting that TORN remains down about 96% from its all-time high of $436 back in February 2021.