TON’s price has faced a tough time in July, and this downtrend is continuing into August.

The community is loud as every trader says ’buy the dip’, but the question is that will it stop dipping?

Bear force

The decline in Toncoin’s price has shifted investor sentiment from optimism to pessimism.

TON already has negative funding rate, showing that most investors are now taking short positions, betting on the price to drop further, which also means that many traders expect the price of TON to continue declining.

This could be risky for those buying at current prices.

The price is too low, it’s time to rebound?

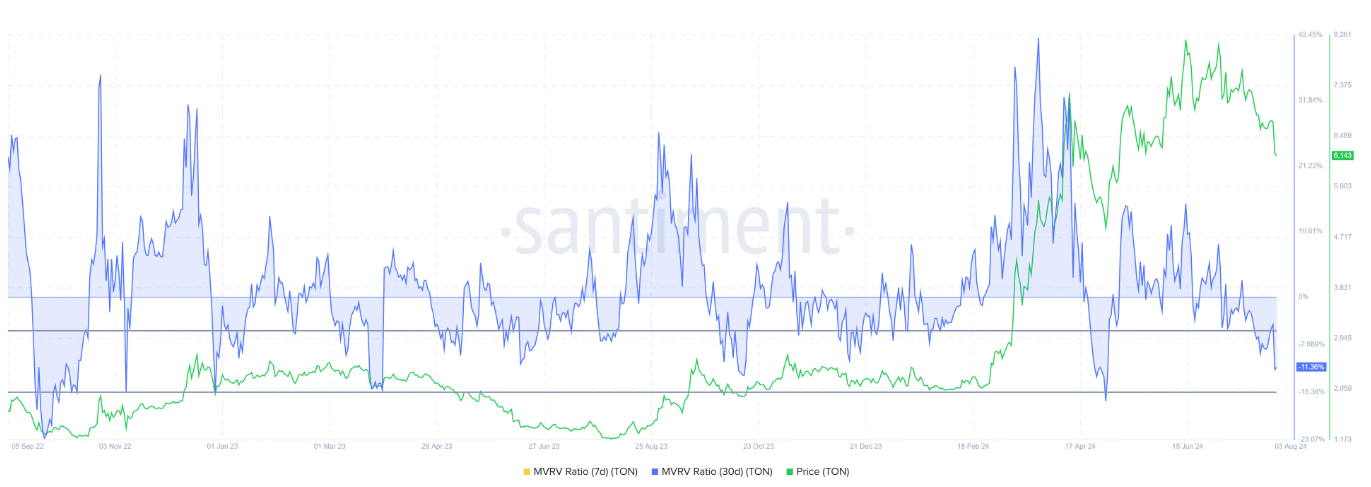

The Market Value to Realized Value (MVRV) ratio, which measures investor profit and loss, also points to potential buying opportunities.

Right now Toncoin’s 30-day MVRV stands at -11%, showing that investors are experiencing losses, or at least unrealized losses, which might lead to increased buying pressure.

Historically, TON has shown recoveries and rallies when the MVRV is between -5% and -15%, indicating that this could be a good time for accumulation.

This is when the ’buy the dip’ becomes louder and louder.

TON holding support, but how long?

At the time of writing, Toncoin is priced at $6.15, testing the critical support level of $6.04.

If the bearish trends continue, and many thinks it will, Toncoin might drop below this support, losing it, and reaching a three-month low, potentially falling to $5.49.

On the other hand, if the support at $6.04 holds, Toncoin’s price could rebound. Regaining the $6.50 mark could lead to further recovery, pushing the price towards $7.00 and invalidating the whole bearish scenario.

Unfortunately, this is pretty unlikely now, as bears seems stronger, and the overall macro environment also not so favorable for any gains.