The amount of paper Bitcoin surged while the actual spot price of the cryptocurrency dropped big time, and an analyst thinks this is a huge problem.

More sellers than ever

Analyst Willy Woo discussed the current state of the Bitcoin market in a thread on X this week, and he higlighted Bitcoin has been experiencing a clear downward trend, mostly because of two major sources of fear.

The German government sold it’s Bitcoin (during Woo’s post it was still in progress) and the ongoing distributions from the Mt. Gox exchange. Two bearwhale.

So far, Mt. Gox only returned 2,700 BTC to their owners, but it still has 139,000 BTC left to distribute, and the market impact of these distributions will depend on whether the recipients decide to sell their coins.

Many await for a selling wave. Despite these concerns, it appears these factors haven’t added too much selling pressure to the market yet.

So, what is really causing Bitcoin’s crash? According to Woo, the real reason seems to be paper BTC.

Sounds like reserve banking

Paper Bitcoin refers to derivatives that don’t involve ownership of actual BTC tokens. ETFs, exchange balances (the keys belong to the exchange, not the „owner”), etc.

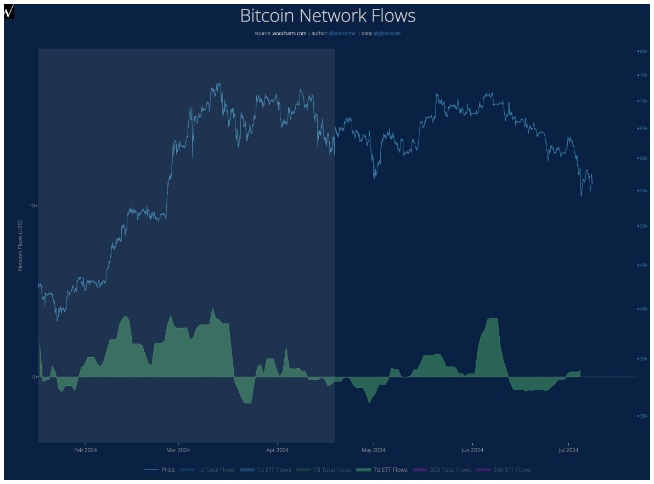

A chart shared by Woo shows Bitcoin’s price trajectory during this latest plunge.

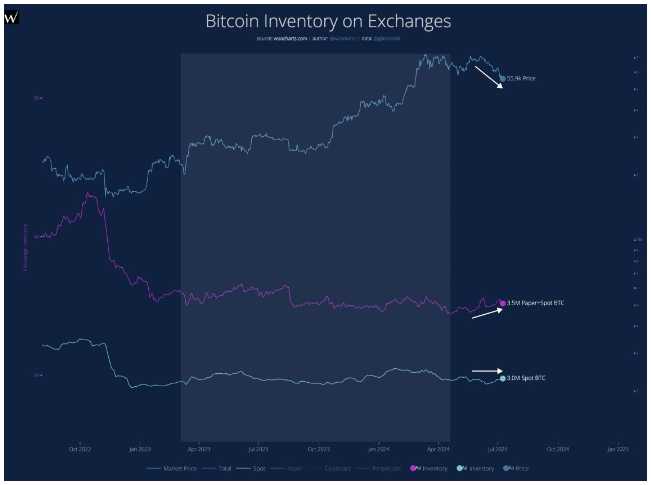

The purple line in the graph represents the combined inventory of paper and spot BTC on various centralized exchanges, which has been rising.

This increase could be due to more spot deposits, but the blue curve shows spot BTC has remained flat while the overall inventory has grown. This means there is no real BTC inflows, but the rise is due to more paper BTC.

A total of 140,000 extra paper BTC was created recently, and Woo points out that this number is much larger than the BTC stack sold by Germany, suggesting that paper BTC is the main cause of the market decline. For Bitcoin to recover, there may need to be a reduction in derivatives.

We are waiting

While the market faces strong bearish pressure from the remaining Mt. Gox sales, there might be a positive development for Bitcoin.

According to Woo, spot ETFs are beginning to show signs of accumulation again. This could potentially lead to a more stable and bullish trend for the cryptocurrency in the future.