It’s been just over a month since spot Ethereum ETFs made their debut. Over this period, these ETFs experienced fluctuating demand, but how it’s going now?

How it started, and how it’s going?

Ethereum ETFs encountered more outflows than inflows since their launch on July 23, so the overall balance is unfortunately negative.

Before the launch, there were high hopes for strong demand and performance, but then, these investment vehicles experienced a quite significant, $465 million in outflows.

Leading the pack in these outflows is Grayscale’s Ethereum Trust, which clearly overshadowed all other inflows into spot Ethereum ETFs.

On its very first day, Grayscale recorded a substantial outflow of $484.1 million, setting a record for the highest daily outflow.

In contrast, BlackRock’s iShares Ethereum Trust ETF stood out with a total inflow exceeding $1 billion. The situation is very similar to the playbook of Bitcoin ETFs.

One month ago, on July 23, the same day as the large outflows from Grayscale, spot Ethereum ETFs saw their biggest single-day inflows, with BlackRock alone bringing in $266.5 million.

Right now there are nine spot Ethereum ETFs available in the United States, with BlackRock’s ETHS and Fidelity’s Ethereum Fund leading the inflow gains.

Investors likes Bitcoin more than Ethereum

The moderate demand for spot Ethereum ETFs may be attributed to investors’ strong preference for Bitcoin, or at least, this is one of the most common eexplanation behind the situation.

Bitcoin’s leading position likely drives the higher demand for its ETFs, leaving Ethereum with less investor interest.

While Ethereum holds the second place in the market, it is often perceived as less influential than Bitcoin, both in terms of price and overall market impact, and more importantly, economic capabilities.

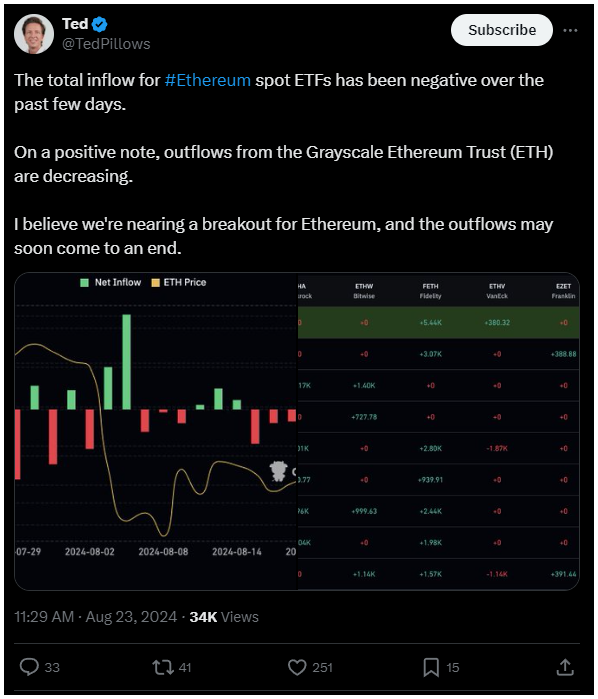

Since August 15, spot Ethereum ETFs have primarily recorded outflows, with BlackRock and several other ETFs showing no flows at all.

Ethereum price in jeopardy?

Crypto analyst Ted Pillows recently took to X to suggest that the outflows from Ethereum ETFs might be nearing their end.

He thinks that outflows from Grayscale’s Ethereum ETF have been the main driver of the negative trend but also observed a gradual reduction in these outflows.

Maybe the relief is close. Pillows speculates that this diminishing trend could be a precursor to a price breakout for Ethereum as the market stabilizes.