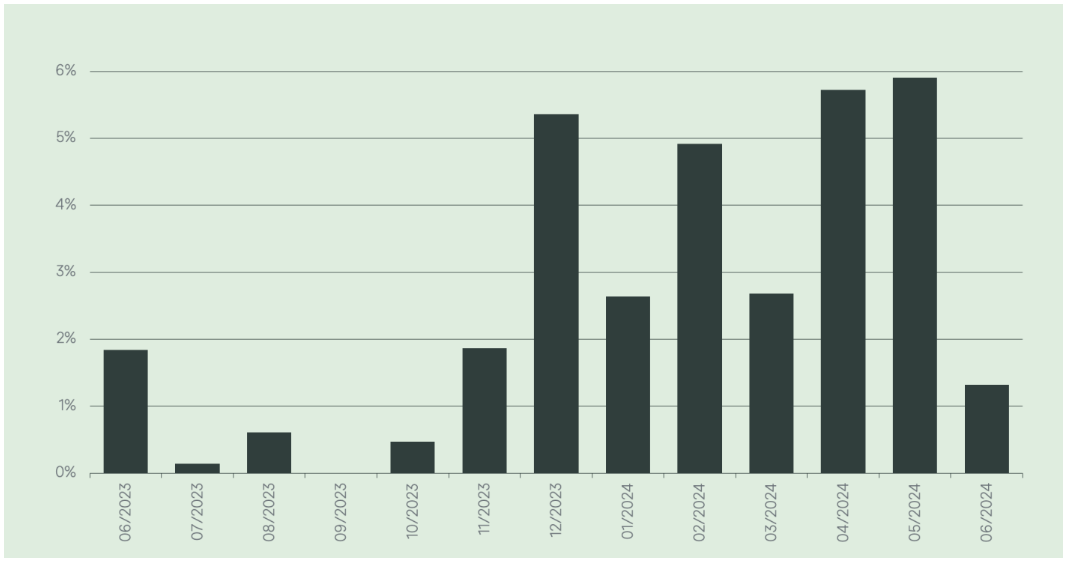

Not an exact day, but in June, the stablecoin supply growth has slowed big time, hitting just 1.5%, according to a report by crypto custodian Copper.

This is a huge difference from the 5%+ growth rates both in April and May.

Silent June so far

USDT, the leading stablecoin, experienced its lowest liquidity boost of the year in June. There are way too few buyers.

Next to this, there has been increased interest in gold, with Tether even launching a gold-backed synthetic dollar, but in general, the crypto markets aren’t seeing the same inflow of money as before.

Bitcoin and Ethereum are struggling, and smaller altcoins aren’t gaining momentum either.

There is also concerns among traders and investors, surrounding the possible listing of an Ethereum ETF, which is considered as positive thing, but the uncertainty is high.

No staking, how it will be the yield?

Investors are curious whether the tokenomics will attract them since ETF investors cannot earn staking yields.

Instead, attention is now on how quickly Ethereum is burning through its supply. So there are still open questions in this case, and Copper’s experts think this influencing the market.

Over the past 70 days, Ethereum’s supply has slowly increased, with an annual inflation rate of 1.39%, which is almost a double Bitcoin’s inflation.

“This means that less liquidity is moving into crypto markets as Bitcoin and Ethereum face downward pressures, and altcoins remain far behind with little hope of any rally in the short term. Bitcoin’s price is following a uniform path relative to these flows. While this is not a measure of bullish demand, it shows whether investors are less enthusiastic about offloading their Bitcoin at a discount, even if they anticipate a crash.”

Bitcoin is the apex predator

A newly released report from Bybit, covering December 2023 to May 2024, shows that Bitcoin continues to dominate the exchange’s wallets, accounting for 26% of all assets held on their platform.

The share of stablecoins has dropped from over 50% in December to just under 43% by May. Not a big decreasing, but still a drop.

Institutional investors are leaning more towards Bitcoin and Ethereum, seeing them as major assets. The so-called blue-chips. In May, institutional investors held 38.9% of their crypto in Bitcoin and 20.3% in Ethereum.

Retail traders also prefer Bitcoin over Ethereum, though the difference isn’t as big.