The Swiss National Bank rejected a proposal to add Bitcoin to its reserves, citing stability, liquidity, and security concerns.

At a shareholder meeting in Bern on April 25, Swiss National Bank Chairman Martin Schlegel said,

“cryptocurrency cannot currently fulfil the requirements for our currency reserves,”

according to Reuters.

The rejection comes amid mounting pressure from the local crypto sector. Luzius Meisser, board member of Bitcoin Suisse, told Reuters,

“holding bitcoin makes more sense as the world shifts towards a multipolar order.”

He added that the weakening of the dollar and euro increases the urgency.

Earlier in March, Schlegel had already dismissed the idea of a Bitcoin reserve. He pointed to Bitcoin’s volatility, limited liquidity, and security risks as barriers.

The Swiss National Bank has not signaled any change in position regarding Bitcoin reserve holdings.

Swiss Bitcoin Campaign Pushes for Constitutional Amendment

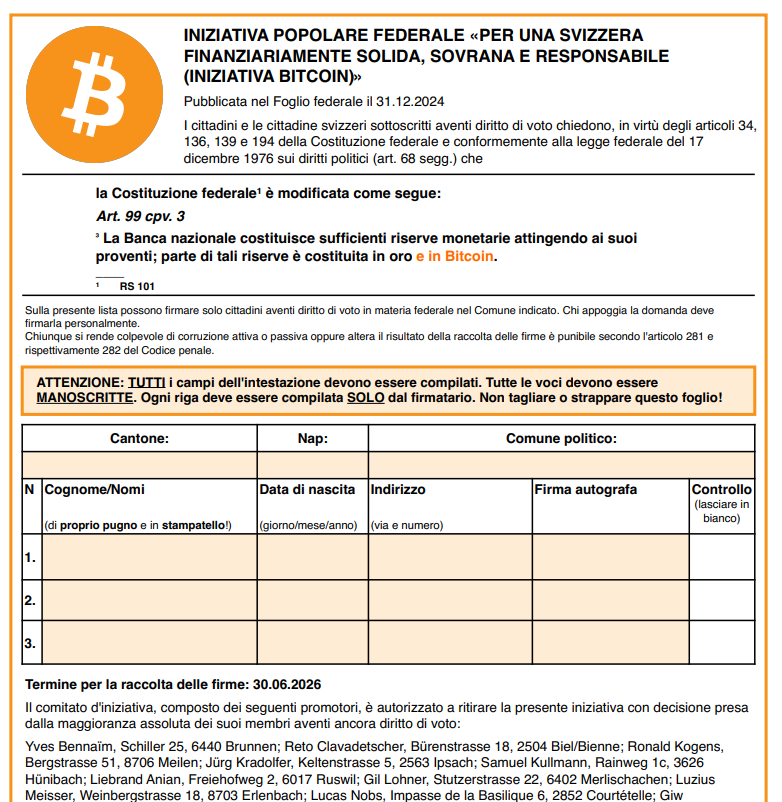

The Swiss Federal Chancellery launched a campaign on December 31, 2024, to amend the Swiss constitution and require Bitcoin holdings at the Swiss National Bank.

The Swiss Bitcoin campaign aims to change Article 99, paragraph three, which now states the SNB must hold part of its reserves in gold.

The proposed amendment would add “and in Bitcoin” to the constitutional text. To trigger a referendum, campaigners must collect 100,000 signatures.

The campaign uses a document titled “Signature collection document” hosted on InitiativeBTC.ch.

The Swiss Bitcoin campaign is backed by the nonprofit think tank 2B4CH. Key figures include Giw Zanganeh, Vice President of Energy and Mining at Tether, who helped launch the initiative.

The campaign seeks to force a national debate on including Bitcoin alongside traditional reserve assets.

Crypto Valley Growth Strengthens Swiss Bitcoin Campaign Supporters

Supporters of the Swiss Bitcoin campaign argue that Bitcoin could reduce dependence on foreign currencies like the US dollar and the euro. Luzius Meisser explained,

“Politicians eventually give in to the temptation of printing money to fund their plans, but bitcoin is a currency that cannot be inflated through deficit spending.”

Yves Bennaïm, founder and chairman of 2B4CH, told ,

“We are not saying — go all in with bitcoin, but if you have nearly 1 trillion francs in reserves, like the SNB does, then it makes sense to have 1–2% of that in an asset that is increasing in value, becoming more secure, and that everyone wants to own.”

Switzerland’s Crypto Valley, centered in Zug, remains a leading hub for blockchain enterprises. By 2024, the Crypto Valley’s ecosystem reached a valuation of $593 billion.

Last year, 17 new crypto startups achieved unicorn status. In April 2025, Spar, a global grocery chain, rolled out Bitcoin payments in a Swiss city, reinforcing blockchain adoption.

Despite the Crypto Valley’s success and ongoing Bitcoin initiatives, the Swiss National Bank maintains its cautious stance against Bitcoin reserve holdings.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.