Swedish authorities classified certain crypto exchanges as key players in organized crime, identifying them as professional money launderers

Investigation, monitoring, and tracking

The FIU announced that these money launderer operations have direct connections to criminal organizations and facilitate money laundering for various individuals and networks.

They categorized these exchanges into four different profiles, based on their main characteristics, and shared that this classification also highlights the seriousness of the issue and – as almost always – a need for stricter government oversight.

The report also mentioned the importance of law enforcement being more active on crypto trading platforms to combat illegal activities.

The FIU expressed concern that illicit cryptocurrency providers pose an emerging threat within money laundering schemes and play an important role in helping organized crime expand its operations.

Licensed exchanges has their role in fighting money laundering, so the authorities urged the legitimate platforms to monitor suspicious trading behaviors and take appropriate actions, such as halting transactions or terminating accounts.

Regulated business

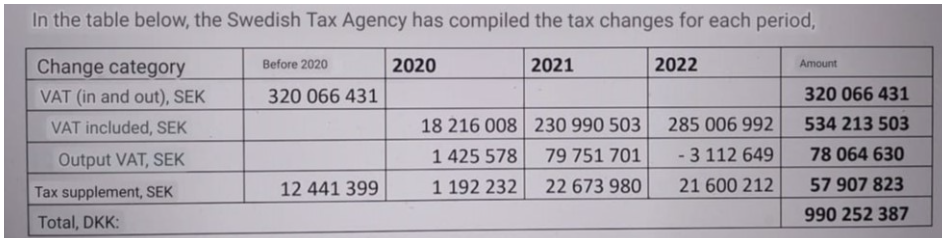

In a related effort, the Swedish Tax Agency also investigating crypto-mining companies for tax compliance.

Between 2020 and 2023, they looked into 21 firms and found that many submitted misleading or incomplete information to avoid paying value-added tax.

The agency reported that this behavior results in lost tax revenue for the country.

The investigation revealed that 18 of these firms filed incorrect tax documents, leading to a demand for $90 million in unpaid taxes.

Some companies have appealed this decision, with two firms winning their appeals based on court adjustments.

Tightening the grip

These actions by Swedish authorities reflect a growing trend among national governments worldwide to regulate and control the cryptocurrency industry more strictly, and experts say it’s very likely we may see similar measures adopted elsewhere, in other countries too.

This could lead to increased compliance requirements for crypto firms globally, affecting how they operate and engage with customers.