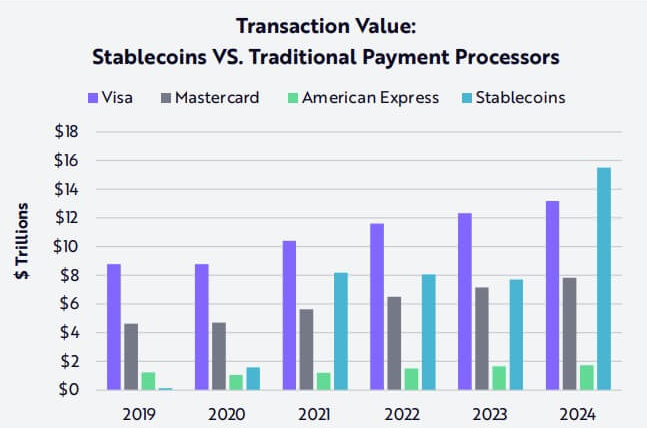

Ark Invest’s 2024 Big Ideas Report revealed that stablecoin transactions hit $15.6 trillion in 2024. That’s more than what Mastercard and Visa processed, 200% and 119% more, to be exact.

And the best part? This happened despite a brutal two-year crypto bear market where stablecoins lost over 70% of their market cap.

Stablecoins are on fire

Stablecoins aren’t just some niche crypto tool anymore, but became a full-blown financial force. In 2024, people used them to send money over 100 million times per month, with a good chunk of those transactions outpacing Mastercard (72%) and Visa (41%).

For context, back in 2023, stablecoin transactions were valued at around $7 trillion, while Visa led the pack with $13 trillion in payments. Fast forward a year, and stablecoins have not only caught up, but they’ve zoomed ahead big time.

Who’s leading the charge?

No surprise here, Tether and Circle are still running the show, as together, they make up 90% of the stablecoin supply.

Tether alone raked in $5.2 billion in profits in the first half of 2024, proving that the stablecoin industry isn’t just growing but thriving.

Ark Invest also noted that stablecoins like USDT, USDC, DAI/USDS, and USDE collectively brought in $3.35 billion in revenue during the latter half of 2024, and that’s an annualized rate of $6.7 billion. Not too bad for an industry that regulators were once eager to write off.

Force of political changes?

As stablecoins continue their world domination, the U.S. government is taking notice. David Sacks, President Donald Trump’s AI and crypto policy lead, has hinted that stablecoin regulation is a top priority.

In response, Republican Senator Bill Hagerty just introduced a bill to establish a clear regulatory framework for stablecoin use.

The U.S. isn’t just looking to regulate stablecoins, they’re hoping to use them to maintain the dollar’s dominance. And with the global rise in stablecoin adoption, it seems like America is trying to stake its claim as the ultimate crypto powerhouse.

Have you read it yet? Missouri goes crypto, after a bill proposes Bitcoin stash for state funds

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.