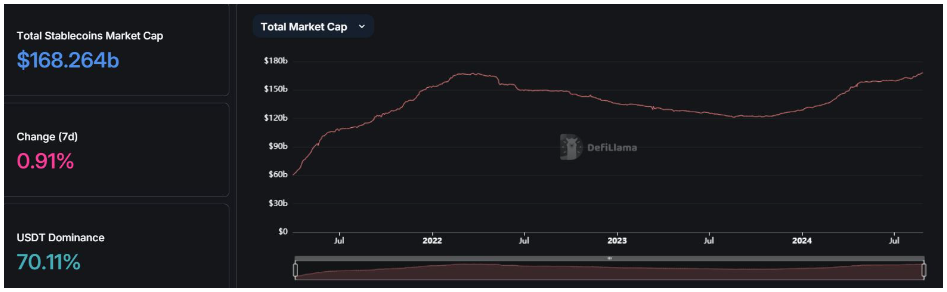

The total market cap for stablecoins, excluding the algorithmic ones, has hit an all-time high of $168 billion after steadily rising for 11 consecutive months.

Impressive growth

The stablecoin market cap just reached to its highest point in history, surpassing the previous peak from March 2022.

The data doesn’t include algorithmic stablecoins, which maintain their value through algorithms instead of being tied to external assets, for example a fiat currency.

The stablecoin market reached $167 billion in March 2022, only to drop big time to $135 billion by the end of that year. But now it seems there is renewed confidence in these assets.

Retail or institutional money?

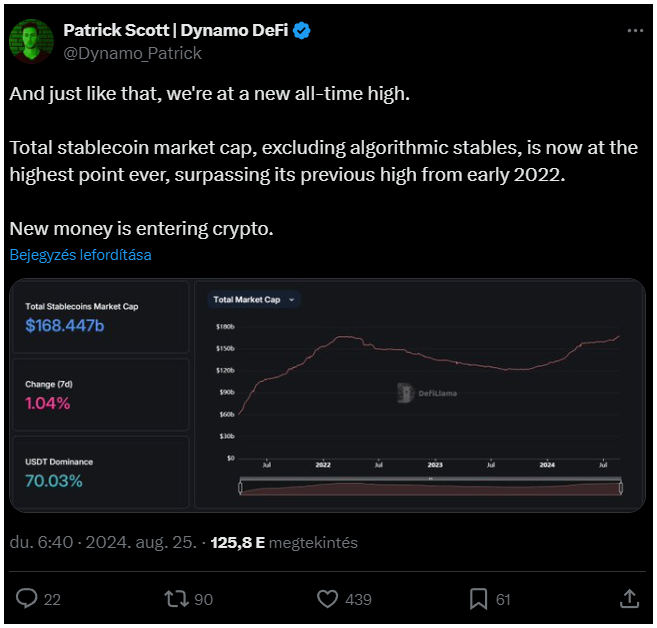

Crypto analyst Patrick Scott, also known in the social media as Dynamo DeFi, commented on this milestone on X, attributing the growth to new funds entering the cryptocurrency space.

While Scott didn’t speculate on the exact reasons behind this uptick, he mentioned that retail investors have remained active in the market for at least eight months.

His statement also raises questions about whether institutional investors are also contributing to this market resurgence, although we didn’t see clear evidence yet.

Market dominance

USDT continues to dominate the stablecoin market, crossing the $117 billion mark for the first time in this month.

Circle’s USD Coin also saw positive growth in 2024, reaching a market cap of over $34 billion, though it’s not all-time high yet, USDC’s cap was $55.8 billion in June 2022.

As always, not all trends are positive. A report by CCData revealed that stablecoin trading volumes fell by 8.35% in July, dropping to $795 billion, likely due to decreased activity on centralized exchanges.

The Markets in Crypto-Assets Regulation, the infamous MiCA in Europe also raised concerns about USDT’s future in the region, contributing to this decline.