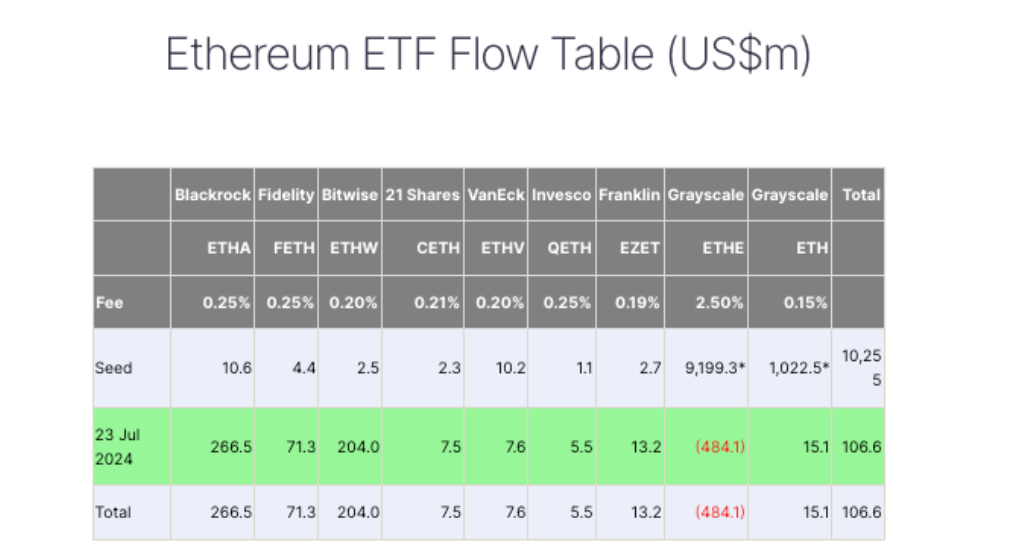

The newly launched spot Ethereum ETFs saw big interest, achieving net inflows of $106.6 million on their very first trading day.

This positive result comes even as Grayscale’s Ethereum Trust experienced heavy outflows.

Issuers assemble

On the first day of trading, BlackRock’s iShares Ethereum Trust ETF led with $266.5 million in inflows.

Close behind was the Bitwise Ethereum ETF with $204 million, and the Fidelity Ethereum Fund ETF secured third place with $71.3 million in net inflows.

These strong inflows to the new spot Ether ETFs helped counterbalance the giant $484.9 million outflows from Grayscale’s Ethereum Trust, which represented a 5% decrease from its previous $9 billion valuation. Pretty nice start!

Grayscale casts dark shadows

The Grayscale Ethereum Trust, launched in 2017, allowed institutional investors to buy ETH but included a six-month lock-up period for investments.

Its recent conversion to a spot ETF made it way easier for investors to sell their shares, and they did exactly this, likely contributing to the huge first-day outflows.

A similar trend was observed earlier this year with the launch of spot Bitcoin ETFs, where Grayscale’s Bitcoin Trust saw $17.5 billion in outflows.

Grayscale’s Ethereum Mini Trust, a lower-fee product, also attracted $15.2 million in new inflows.

Other spot Ether ETFs, like Franklin Templeton’s Franklin Ethereum ETF and 21Shares’ Core Ethereum ETF saw $13.2 million and $7.4 million in inflows, respectively.

In total, spot ETH ETFs achieved a cumulative trading volume of $1.08 billion on their debut, representing 23% of the trading volume seen by Bitcoin ETFs on their first day.

First day of the ETHness stakes done. The group's volume was just shy of $1.1 billion. My *prediction* on flows for the day is anywhere from $125 million to $325 million but will depend on how many investors these firms had lined up. We'll know some official flows in a few hours https://t.co/p6Wjty8VyY pic.twitter.com/1gYYrU1CW1

— James Seyffart (@JSeyff) July 23, 2024

Up and down

Despite the strong performance of the spot Ether ETFs, the price of ETH dropped slightly. As of now, ETH is trading at $3,177, down 8% over the past 24 hours and 8,1% over the past week.

Spot Ether ETFs were approved by the SEC on July 22 and began trading in the U.S. on July 23., and many warned the same will happen with Ethereum ETFs what happened with the Bitcoin ETFs. After the start of the trading, the price declined a little.