The Solana-based memecoin platform Pump.fun has generated a pretty impressive $5.3 million in revenue over the last 24 hours.

This achievement is bigger than the combined earnings of the next 24 highest-grossing protocols.

Profits beyond expectations

Pump.fun allows users to launch new tokens with minimal costs, and has seen unprecedented, surprising success, raking in $5.33 million in just one single day.

This figure literally dwarfs the daily revenues of well-established networks, with Ethereum bringing in $2.3 million and Solana earning $1.6 million within the same period.

The platform generates revenue by charging a 1% fee on every trade conducted on its platform.

This simple yet effective model has pushed Pump.fun to the top of the earnings charts, even as it faces harsh criticism from various market observers.

Money grab, or real fun?

Pump.fun has been at the center of controversy, from the beginning, with critics accusing it of undermining the whole memecoin market.

Which sounds ironic, as we thought the memecoin phenomen is nothing but a joke. It’s in the name.

The platform’s low-cost token deployment feature, which allows users to create a new token for as little as $2, has been blamed for flooding the market with low-quality coins.

In response, Pump.fun doubled down its reputation, boasting about the ability to launch 10,000 new tokens in just three hours during a conversation on X between former President Donald Trump and Elon Musk.

3 hours. Tens of thousands in the trenches. 10,000 coins.

ARE YOU NOT ENTERTAINED!? pic.twitter.com/kr7KkmHzVx

— pump.fun (@pumpdotfun) August 13, 2024

To motivate token creation, Pump.fun announced a new reward system. Token creators will receive 0.5 SOL, around $80 at current prices, if their tokens successfully complete the bonding curve and are deployed on Raydium, a Solana-based automated market maker.

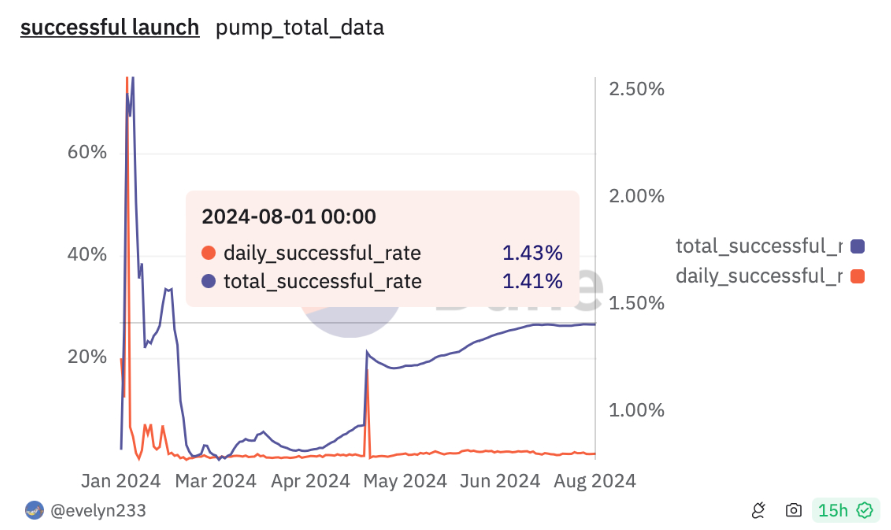

But unfortunately the data revealing that 98.6% of tokens launched on Pump.fun fail to complete this process and never make it to Raydium.

The rise of Pump.fun

Launched in January 2024, Pump.fun was created as a response to the often opaque and unfair practices associated with traditional memecoin launches, such as pre-sales and insider trading.

The platform announced they want to bring transparency to the process by making all token-related data public, allowing anyone to see the number of tokens in circulation and their ownership distribution. It worked.