Solana’s open interest skyrocketing to an all-time high of $6.68 billion, and it looks like SOL is gearing up to take a shot at its previous record price of $264.

Market forces are pushing Solana up?

In just the last 24 hours, Solana’s open interest has surged by 14%. This spike is no coincidence, it’s closely tied to a notable uptick in trading activity, pushing SOL’s price up by 14% over the past week.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Open interest refers to the total number of unsettled contracts, like futures or options, that traders have on the table, and when this number climbs, it usually means more traders are jumping in, signaling increased market interest and confidence in SOL’s future, aka incoming gains.

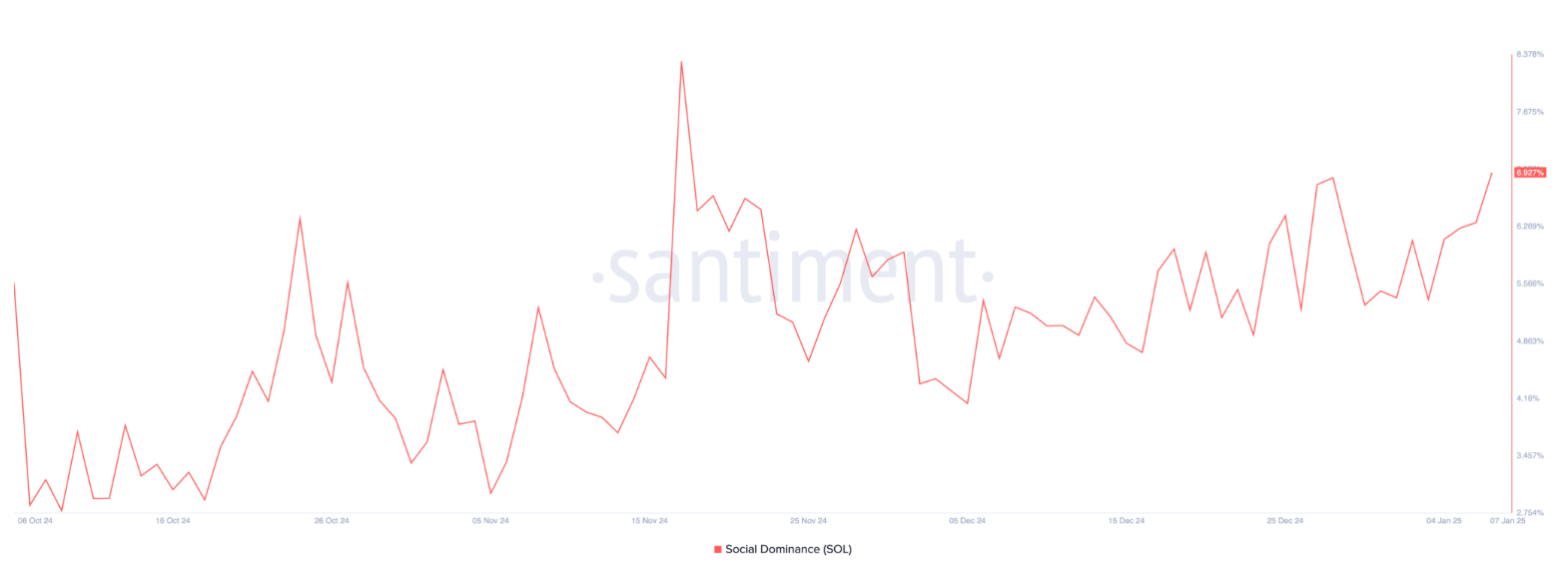

Alongside this surge in open interest, Solana is also enjoying a two-month high in social chatter, now sitting at 6.92%, Santiment shared it. This metric tracks how often an asset is mentioned on social media and forums.

More buzz typically translates to more trading action, which can send prices up as investors flock to get in on the action.

When new ATH?

Looking at the charts, SOL’s Chaikin Money Flow is on the rise too, currently at 0.04. This is a good sign for demand, because when this number climbs, it usually means more people are buying in.

With this growing buying pressure, SOL could very well break through the resistance level at $218.90. If it does, we might just see it revisit that all-time high of $264.

The less lucky script

As always, it’s not all sunshine and rainbows, because if market sentiment takes a nosedive and shifts from bullish to bearish, we might see SOL slip below $200, potentially landing around $188.96.

So, while things are looking up for Solana right now, traders should keep watching for any sudden changes in mood.