In the time of writing the price of Solana is $140, with a trading volume of $928 million over the past 24 hours. Analysts lamenting if $200 is on the horizon?

Key support and resistance levels for Solana

A known crypto trader, Arslan Ali shared an analysis in the social media if SOL can reach $200 in this month?

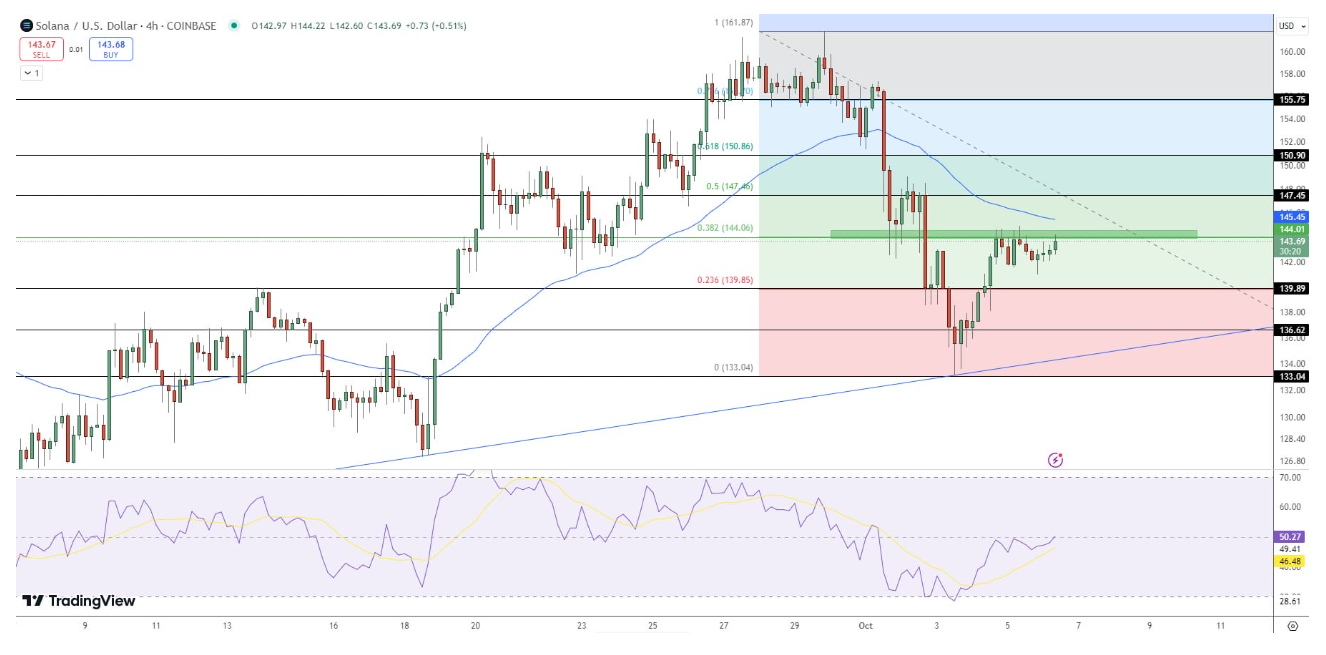

Based on the analysis, Solana’s recent bounce back from a strong support level at $133 indicates a possible bullish trend ahead.

This support level coincides with an upward trendline seen on the 4-hour chart. The upward movement has allowed SOL to test immediate resistance at $144, which aligns with the 38.2% Fibonacci retracement level.

🚀 #Solana shows a strong rebound from $133 support! 🔄 Breaking through the key resistance at $144 could set the stage for a move towards $150+ levels. Can SOL reach $200 this October? 📈💰 #Crypto #SOL #CryptoNews pic.twitter.com/HE6vWtG2C8

— Arslan Ali (@forex_arslan) October 6, 2024

If SOL can break through this important resistance, it could lead to gains towards the next resistance at $147 and eventually reach the 61.8% Fibonacci level around $150.

Can we get a Solana Uptober?

If the price moves downward, immediate support levels are at $139, followed by $136 and $133.

A drop below $133 could invalidate the recent bullish trend and lead to further losses.

The RSI is currently just below 50, which suggests that if it breaks above this level, it could restart the bullish momentum.

For Solana to shot for the $200 level, it first needs to maintain a breakout above the 50-day Exponential Moving Average at $144.

Achieving this could attract more buying interest and push SOL towards higher resistance levels.

Of course, both technical strength and overall market sentiment will play important roles in determining whether or not Solana can reach this goal.

Resistance to conquer

With current market sentiment being neutral and SOL’s RSI around 49, a decisive move above 50 could signal continued bullish momentum.

Solana must break through the 38.2% Fibonacci level of $144 and see the RSI rise above 50 to confirm an ongoing upward trend.

If successful, this could drive SOL towards the targets of $147 and $150 in the short term, potentially setting up for a larger rally toward $200 in October.