The decentralized finance applications on the Solana blockchain are bagging in record earnings as the memecoin frenzy returns to the crypto market.

Solana’s fee bonanza

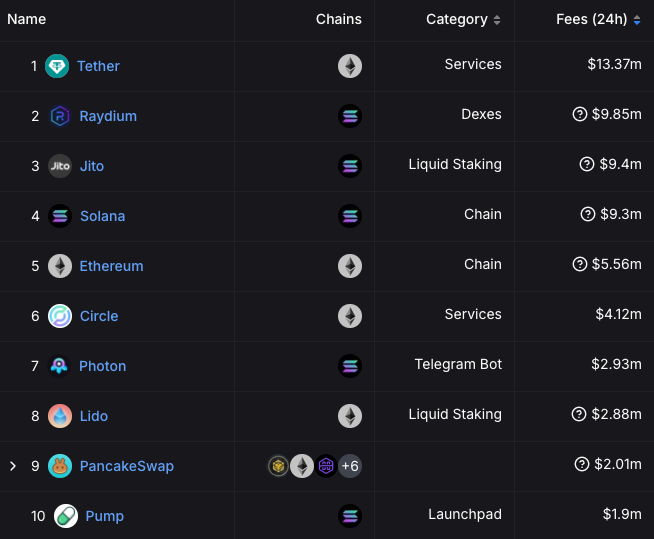

In the last 24 hours, five of the top ten crypto protocols by fee earnings were from Solana, according to a new post by DeFi commentator Patrick Scott.

This is thanks to a mix of excitement around memecoins and some big time price movements for Solana itself.

Raydium hit a pretty nice $11.3 million in fees on November 17. Not to be outdone, the liquid staking protocol Jito brought in its third-highest daily earnings at $9.87 million on the same day.

Pump.fun, the memecoin launchpad, scored $1.65 million in fees, its seventh-best day ever. Even Photon, a Telegram trading bot focused on Solana memecoins, generated $2.36 million in fees, marking its fifth-highest day.

Memecoins, the stars of the party

What’s driving all this activity? A wild resurgence in memecoin speculation, but the native Solana token itself has also been on the rise, hitting $242, its highest price since November 2021.

One standout in the memecoin world is Peanut, which skyrocketed over 2,700% in just two weeks to reach a peak market value of $2.4 billion on November 14.

Adding to the excitement, Dogwifhat, another popular Solana memecoin, was listed on Coinbase on November 15, briefly pushing its price to a six-month high of $4.19.

In an interesting twist, the newly announced United States Department of Government Efficiency (DOGE) shares its acronym with Dogecoin (DOGE), which has also enjoyed a significant rally recently, up over 140% in just two weeks! Must be a coinsidence you know.

Solana’s strong performance

As for Solana, it’s currently trading at around $234 and is just 8.5% shy of reclaiming its all-time high of $259.

With a market cap now at $112 billion, 44% higher than its previous peak of $77 billion back in November 2021, Solana is definitely making waves. But this is expected from an Ethereum-killer.

This increase in market cap is partly due to the growth in the number of Solana tokens being issued as part of its inflation schedule.

At present, Solana’s inflation rate sits at 4.9%, decreasing by 15% each year.