Ripple’s victory has set a precedent that can reshape the future of the cryptocurrency industry for years to come.

Security for institutions, but currency for retail?

On July 13, 2023, a significant ruling was made in the case between the United States Securities and Exchange Commission and Ripple Labs.

The court decided that the XRP token isn’t a security when sold on public exchanges.

This decision delivered important consequences for the cryptocurrency market and the regulatory environment in the United States.

The ruling marked a major win for Ripple, and created a precedent for classifying cryptocurrencies.

The SEC originally filed the lawsuit against Ripple in December 2020, claiming that the company conducted an unregistered securities offering by selling XRP tokens. Ripple argued that XRP should be viewed as a currency, not a security.

After a lengthy, multiyear legal battle, the court partially agreed with Ripple, but also found that Ripple violated securities laws when offering XRP to hedge funds and other institutional buyers.

How the tax dollars are spent?

The ruling offered some regulatory clarity for the cryptocurrency industry, which has often operated in a regulatory gray area.

By deciding that XRP isn’t a security when sold on retail exchanges, the court set a precedent that could influence how other cryptocurrencies are classified and more importantly, regulated.

This decision also positively impacted XRP’s market value, the price experienced a nearly 6% increase after the ruling.

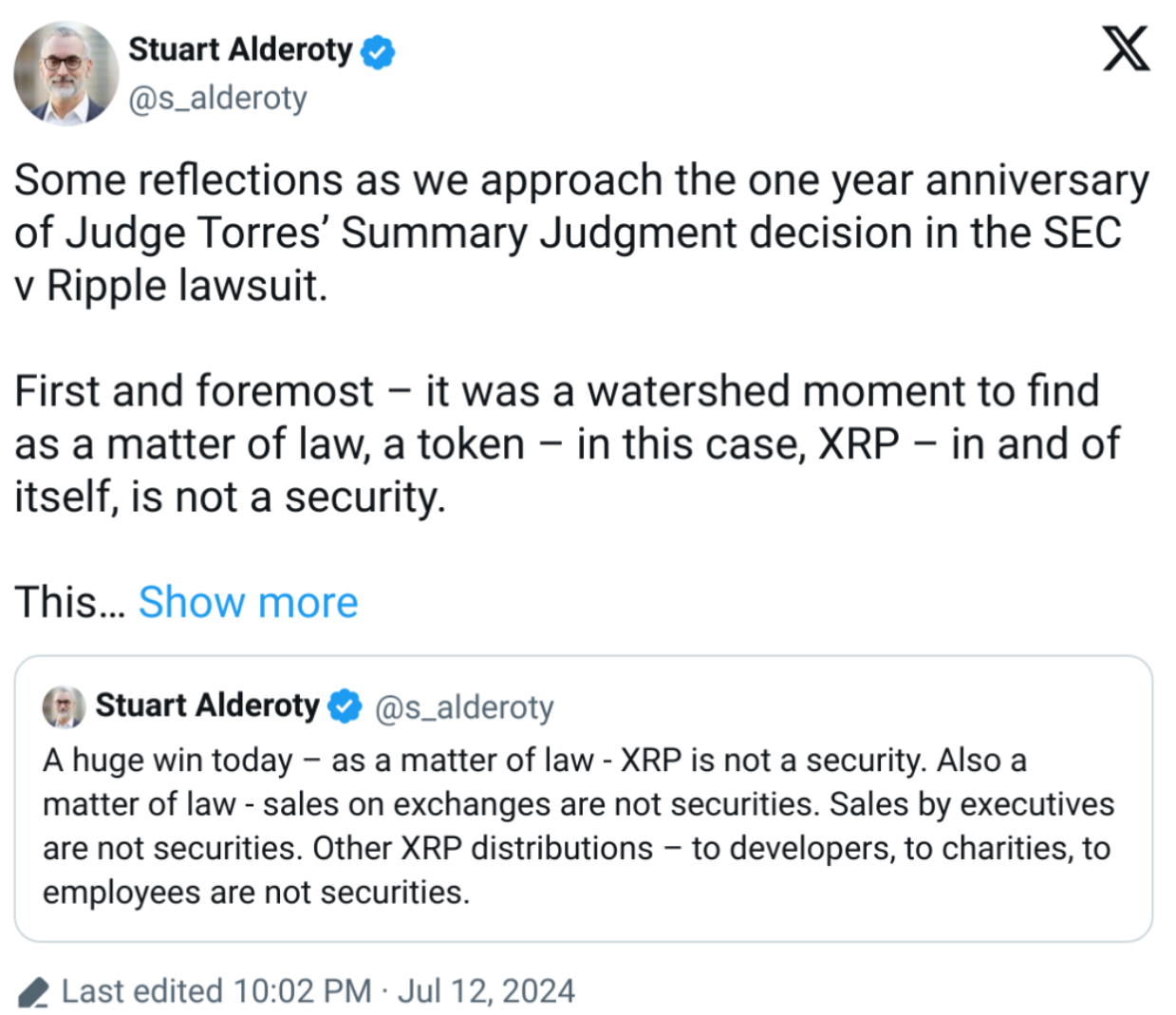

Ripple’s chief legal officer, Stuart Alderoty commented on X that the decision paved the way for other cases, such as the SEC’s case against Binance, to recognize the agency’s overreach and deviation from legal principles under Gary Gensler’s leadership.

Alderoty told that relying on extended litigation to determine the status of each token on a case-by-case basis isn’t too efficient solution.

The bureaucracy is verifying its own importance

Over the past year, the case continued to evolve, with Ripple and the SEC engaging in further legal disputes and negotiations, back and forth.

The SEC hasn’t completely backed down, and the regulatory landscape still remains complex and challenging, as many arguing this is mostly beneficial for the SEC, for the litigation-style regulation.

Despite this, Ripple used this time to strengthen its legal arguments and solidify its position in the market, with some degree of success.