The U.S. SEC could challenge the FTX bankruptcy plan, complicating the repayment process for creditors. Perhaps this is for their safety.

SEC wants to decide in some cases?

The SEC shared it may oppose any distribution of crypto assets, including stablecoins to creditors as part of the FTX bankruptcy settlement, and this casts uncertainty over the estate’s plan, which wanted to return 118% of creditors’ claims in cash within 60 days after court approval.

The issue here is, for the FTX, cash means USD-pegged stablecoins, not actual dollars.

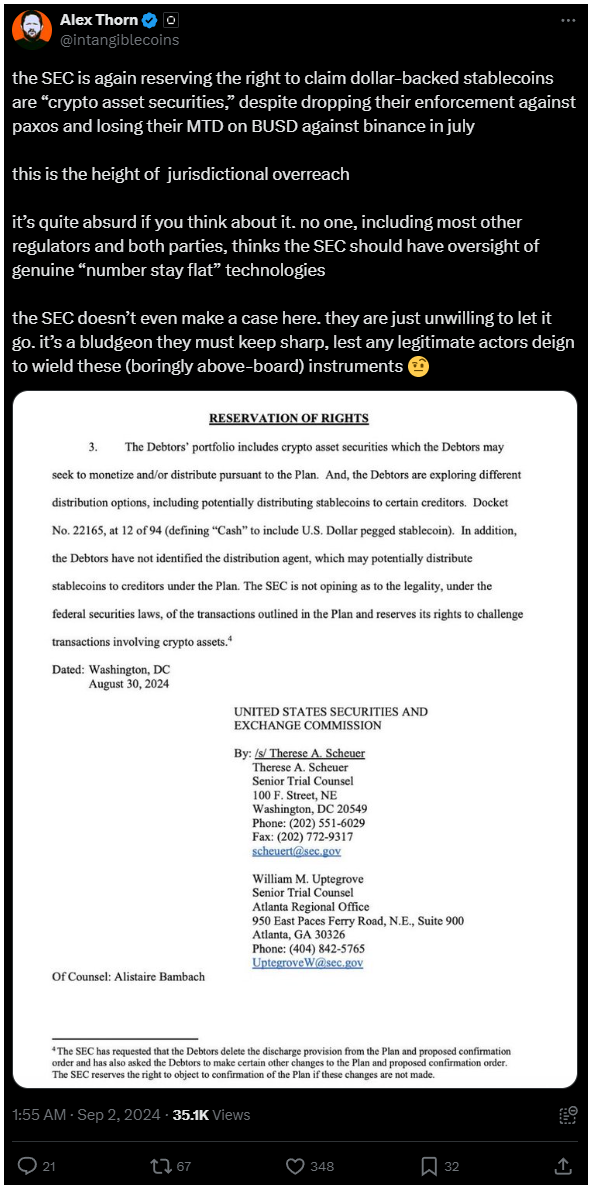

The SEC reserved its right to challenge any such transactions, questioning the legality of distributing crypto assets under federal securities laws.

Cash is king, but which one?

This move by the SEC means more implications for the FTX bankruptcy proceedings.

The agency’s resistance to the proposed plan could delay or complicate the process, especially since the estate hadn’t yet named the distribution agent responsible for handling the stablecoin payouts.

Some experts view the SEC’s actions as hair splitting, or in the worst case, an illegal overreach.

Alex Thorn, head of research at Galaxy Digital, criticized the SEC on social media, arguing that the agency is unnecessarily obstructing a straightforward process.

The SEC also supported the U.S. Trustee’s request to remove a provision in the plan that would discharge the Debtors, and this also could means that the agency may object to the plan’s approval if these changes aren’t made.

Protecting the investors, even from their own money?

While this isn’t the first time the SEC intervened in cryptocurrency-related matters, its potential challenge to the FTX plan adds a new layer of complexity to the ongoing legal battles in the crypto industry. Simply put, it means more drama.

The outcome of this case could set a precedent for how future bankruptcy settlements are handled, and if the SEC succeeds in blocking the use of stablecoins for repayment, it can influence other crypto bankruptcy cases too.