Saudi Arabia has taken a big step by joining China’s initiative on Central Bank Digital Currencies, CBDCs through Project mBridge. This move is the next level in the global adoption of CBDCs.

It’s over for the petrodollar

The U.S. has boosted its unconventional oil production, strengthening its role in the global oil market and the dominance of the U.S. dollar in oil trade.

This is the oldschool way, what we all know. But now this situation may change as the long-standing petrodollar agreement between Saudi Arabia and the United States nears its end.

Saudi Arabia’s involvement in a China-led digital currency trial means at a possible move away from the dollar for global oil transactions. Bad news for the U.S.

According to Reuters, Josh Lipsky, who oversees a global CBDC tracker at the Atlantic Council, noted that the common work of the world’s largest oil exporter and the most advanced cross-border CBDC project is significant.

He mentioned that in the coming year, we might see an increase in commodity settlements, particularly between China and Saudi Arabia, not in dollar, but by this new technology.

The new system

The Bank for International Settlements recently announced that Saudi Arabia’s central bank will become a full participant in Project mBridge.

Launched in 2021, mBridge initially involved the central banks of China, Hong Kong, Thailand, and the UAE, focusing on developing a CBDC platform to enable swift cross-border payments and settlements.

With Saudi Arabia now the sixth full participant, the project has garnered over 26 global entities, including the IMF, World Bank, and ECB, as observers.

They want CBDCs badly

While these developments unfold, the U.S. has taken a different stance on CBDCs.

The U.S. House of Representatives recently passed the CBDC Anti-Surveillance State Act, which prevents the Federal Reserve from issuing a CBDC.

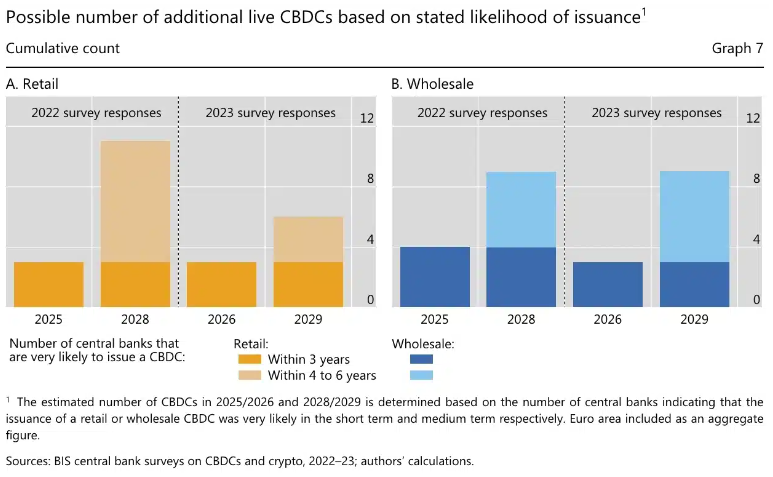

A survey by the BIS showed that 94% of central banks, up from 90% in 2021, are actively exploring CBDCs.

This survey, which included 86 banks, indicated a preference for wholesale CBDCs over retail ones in the coming years.

Saudi Arabia’s participation in Project mBridge could influence the global financial system, especially in reducing the world’s reliance on the U.S. dollar for oil transactions.

The success of Project mBridge could pave the way for more countries to adopt CBDCs, transforming the global financial and commodity trading systems.