The real-world asset tokenization sector is on track for explosive growth, with projections suggesting it could expand more than 50 times by 2030.

This growth could reshape how people invest and own assets, potentially reaching a market size of over $10 trillion.

Promising predictions

In 2024, the RWA tokenization sector has already shown big progress, and experts from major financial institutions and consulting firms believe this trend will continue.

According to a Tren Finance research report, most firms estimate that the RWA market could grow to between $4 trillion and $30 trillion.

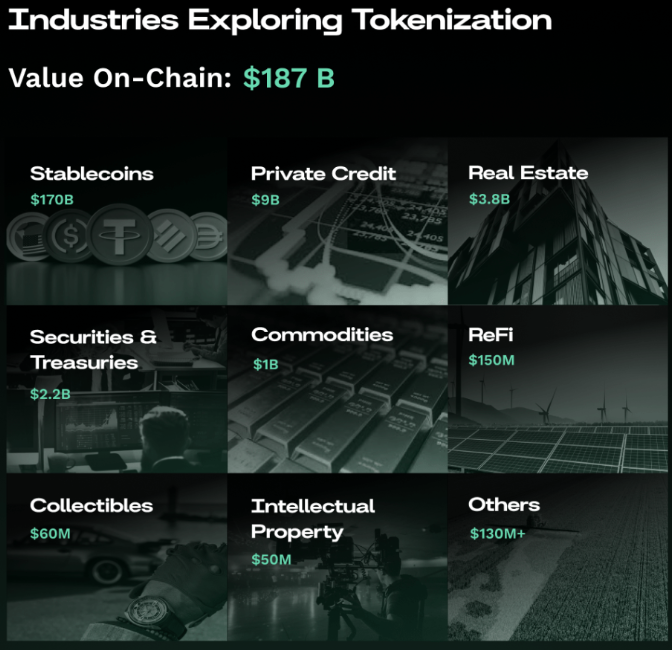

If the sector hits the median prediction of around $10 trillion, it would mean a pretty impressive increase from its current valuation of $185 billion, which includes stablecoins.

The sector is still in its infancy

As the RWA sector develops, it is expected to capture a larger share of global financial markets.

The integration of traditional finance with blockchain technology is seen as a fundamental change that will create a more accessible and efficient financial ecosystem.

The Tren Finance report highlights that this shift will change fundamentally how people invest, trade, and own assets.

The advantages of RWA tokenization

Now stablecoins dominate the RWA market, making up over $170 billion of its value. In contrast, tokenized securities and treasuries are valued at only $2.2 billion.

Bringing real-world assets onto the blockchain offers many benefits, especially in finance. Tokenization can make transactions faster and cheaper while eliminating the need for third-party intermediaries and avoiding geopolitical barriers.

Christian Santagata, product marketing manager at RWA protocol re.al, explains that continued development in this area could greatly enhance decentralized finance.

He notes that combining DeFi innovations with RWA tokenization opens up endless possibilities. This combination improves capital efficiency and introduces new financial tools tailored for this emerging market.