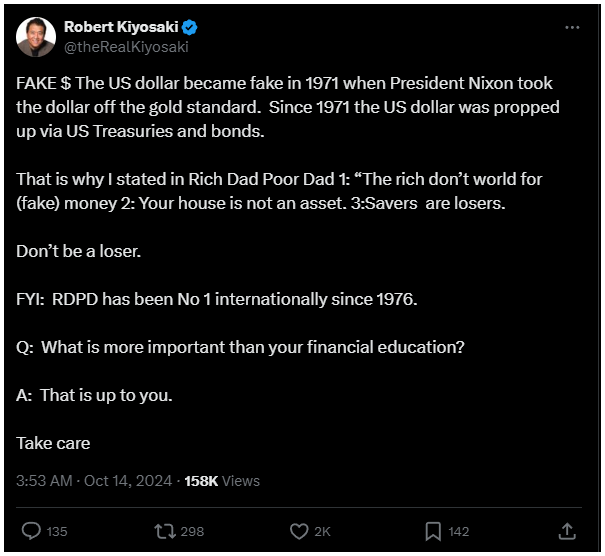

The author of “Rich Dad Poor Dad,” expressed serious concerns about the stability of the U.S. dollar in a new tweet.

He attributes the dollar’s current issues to decisions made long ago, particularly President Nixon’s choice to remove the dollar from the gold standard in 1971.

World’s reserve currency

Kiyosaki argues that since that decision, the U.S. dollar has relied on government bonds and treasuries, which he believes are essentially worthless.

He claims this shift has had lasting negative effects on the U.S. economy.

Before 1971, the dollar was tied to gold, giving it a stable value compared to other currencies, but Nixon’s decision to stop converting dollars into gold ended this system and turned the dollar into a fiat currency.

Now, its value depends on market feelings and government debt. Kiyosaki criticizes this change, saying it has further weakened the dollar and increased reliance on U.S. Treasuries and Bonds.

He sees this shift as a turning point, highlighting that after the Federal Reserve began printing more money to manage debt, the purchasing power of the dollar has continued to fall, and government debt skyrocketed.

Kiyosaki explains that this money printing has led to inflation, making products and services more expensive and diminishing the value of money.

Alternative investments, the way out?

Kiyosaki warns that inflation makes saving in U.S. dollars increasingly risky. As prices rise, money loses its purchasing power, meaning savings become less valuable over time.

He believes traditional savings accounts aren’t effective for preserving wealth in this environment.

Instead, Kiyosaki urges investors to explore other investment options that are less impacted by inflation.

He suggests that gold, silver, and Bitcoin are safer choices for protecting wealth.

The game is rigged?

For example, gold recently reached record highs, which Kiyosaki argues shows that precious metals will maintain their value better than the dollar during economic challenges.

Similarly, Bitcoin and other cryptocurrencies are viewed as tools for protecting against inflation.

Kiyosaki recommends diversifying investments with gold, silver, and cryptocurrencies to safeguard against economic collapse.

Kiyosaki is well known for loudly criticizing the U.S. financial system, which he sees as heavily reliant on debt.

He also points out that market instability is partly due to the Fed’s ongoing interest rate cuts and rising government debt.

Reflecting on the 2008 Great Recession, he warns that current economic trends could lead to another crisis if not addressed properly.