Institutional investors can securely pouring money into cryptocurrencies like XRP and RLUSD, after Ripple and South Korean custodian BDACS are making this possible with their new partnership.

This strategic alliance is set to revolutionize crypto custody in South Korea, offering institutional-grade services for XRP, Ripple USD, and other digital assets.

Partnership between big players

This partnership allows BDACS to integrate Ripple Custody, providing a secure and reliable infrastructure for financial institutions in South Korea.

Ripple President Monica Long is excited about this move, seeing it as a key step in South Korea’s growing institutional crypto adoption.

The partnership aligns with South Korea’s Financial Services Commission roadmap, which wants to encourage institutional participation in the digital asset market.

Why it is a big deal?

BDACS CEO Harry Ryoo emphasizds the importance of secure infrastructure for institutional crypto adoption, and told that this partnership will not only support the growth of the XRP Ledger ecosystem but also boost the usability of Ripple’s stablecoin, RLUSD.

It’s a win-win for both companies, boosting and expanding the crypto ecosystem.

The future is bright?

Ripple is looking ahead, expecting the total amount of custodied cryptocurrencies to reach $16 trillion by 2030.

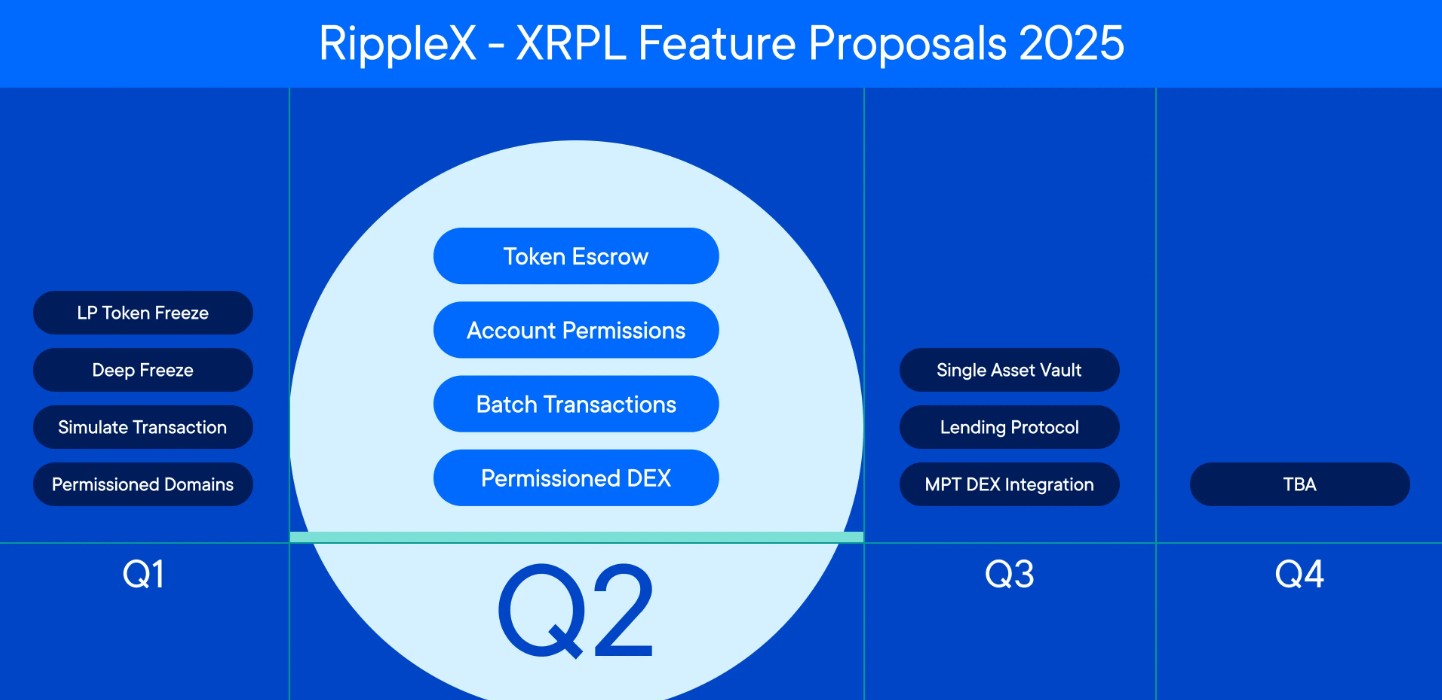

Alongside this partnership, Ripple is unveiling a roadmap for building an institutional DeFi ecosystem on the XRP Ledger, that includes a permissioned decentralized exchange, a credit-based lending protocol, and a new token standard.

It’s an exciting time for crypto in South Korea, and this partnership is likely just the beginning.

For those invested in crypto, this partnership offers a sense of security and stability. Imagine being able to trust your digital assets with a reputable custodian, knowing they’re safe and compliant with regulations.

That’s what Ripple and BDACS are offering, making it easier for institutions to join the crypto market.

Have you read it yet? The SEC’s crypto retreat means is the war on crypto really over?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.