The crypto market has been hit hard, with all of the top 10 digital currencies experiencing painful declines. Even the most established ones couldn’t avoid the sell-off.

Major losses for traders

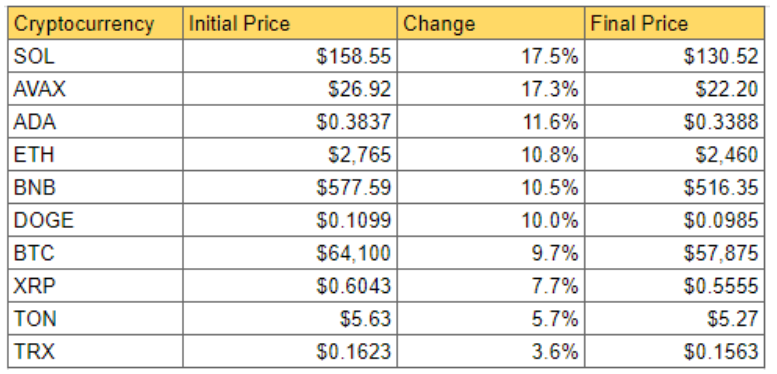

Tron managed to come out with the smallest loss among the top 10, dropping by just 3.6%.

Toncoin followed closely, falling 5.7%, which is surprising given the sh*tstorm surrounding it now. XRP didn’t fare as well, sliding by 7.7%, while Bitcoin saw a 9.7% decrease in the beginning of the week.

Bitcoin’s drop signals the market’s overall weakness, as its movements often set the trend for other assets.

Dogecoin fell by 10%, BNB, the native token of the Binance exchange, also suffered a heavy loss, dropping 10.5%.

Ethereum faced a 10.8% decline, showing that even the giants aren’t safe from the market’s volatility.

Cardano, which has been struggling to gain traction lately, continued its downward slide, falling 11.6%. Avalanche tumbled by 17.3%.

But the biggest loser was Solana, which took the hardest hit, plunging by 17.5%, the biggest drop among the top 10.

Market decline

None of the top cryptocurrencies escaped this week’s market downturn, and this is a pretty rare moment when no digital asset could claim victory over others.

The crypto market is indeed unpredictable, where even the most solid investments can suddenly lose price.

Investors are now left wondering what will come next as the market continues its rollercoaster ride. Bitcoin hodlers aren’t wondering, they’re just hodl as usual.

Volatility is a feature, not a bug

The recent market trend has been largely negative, but it’s worth to remember that crypto markets are known for their legendary volatility.

Sudden price swings, often much bigger than is the traditional finance are common, and just because a coin has performed poorly this week doesn’t mean it will continue to do so.