Raydium has shaken up the decentralized exchange sector by overtaking Uniswap, becoming the busiest DEX lately, thanks to a growth in meme token activity.

Raydium takes the lead

In the past days, Raydium has emerged as the top player, leaving Uniswap behind, after a record-breaking period of memecoin trading, fueled by new inflows from platforms like Pump.fun and established Solana-based tokens.

Raydium’s rise is based on its impressive user numbers over the past 30 days.

During this time, Raydium attracted around 90 million active wallets, while Uniswap managed just 13.9 million.

Raydium now handles more than 60% of all decentralized activity on Solana, even outpacing multi-chain exchanges and the PancakeSwap on BNB Chain.

A big shift in activity

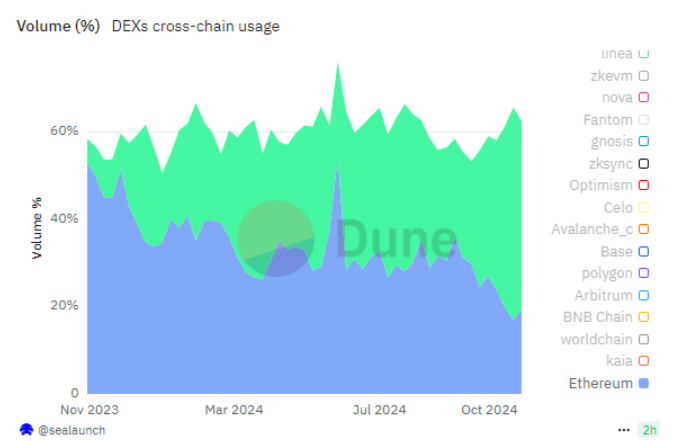

This trend reflects a broader shift from Ethereum to Solana for decentralized trading. Solana has become the most visited DEX platform, claiming between 43% and 48% of all DEX activity in terms of daily visitors since September and October.

Raydium is also seeing impressive daily fees, generating about $3.14 million recently, with over $200,000 in retained revenue.

The DEX currently locks in around $1.4 billion in value, though that’s down from a peak above $1.7 billion.

Trading volumes and memecoins

Raydium is thriving in terms of user activity, but it still lags behind Uniswap in trading volumes.

It also trails behind perpetual swap DEXs and high-liquidity pairs on other platforms. The reason?

Raydium has become a hotspot for memecoin trading, where smaller trades of riskier tokens are common. Interestingly, on some days, even Orca sees higher trading volumes since it lists more established assets.

One reason for Raydium’s popularity is its ability to attract new memecoins. In early October alone, the DEX welcomed over 1,500 new meme assets each week. Most of them are already half-dead projects btw.

Although this influx may slow down soon, the excitement around AI-generated tokens and existing favorites like WIF and POPCAT is keeping things lively.

Most of Raydium’s transaction volume comes from its native platform, but Jupiter also helps drive some activity by connecting users to various trades.

The community around Jupiter plays an important role in bringing traffic and liquidity to Raydium.