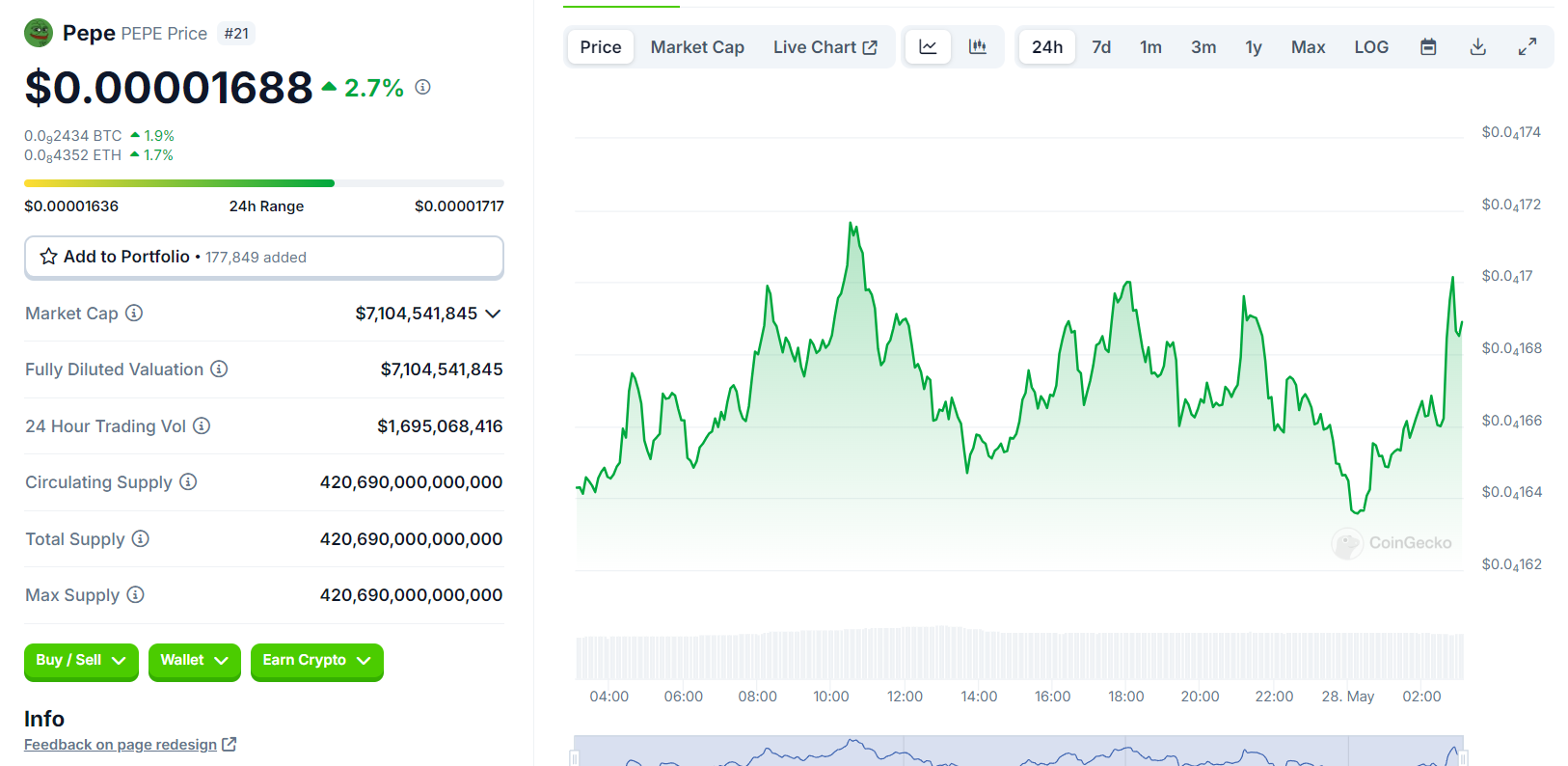

Over the past month, the PEPE memecoin has surged by over 100%, making it the third-largest memecoin by market capitalization, right after DOGE and SHIB.

This increase is fueled by a combination of social media hype and a significant buying spree by large investors, often referred to as whales.

Goin’ shoppin’

A recent report by Lookonchain, a blockchain analytics platform, highlighted a whale withdrawing a humble 500 billion PEPE from Binance, a major cryptocurrency exchange.

This mass accumulation by a single large investor suggests a very substantial vote of confidence in PEPE’s future prospects.

The primary drivers behind PEPE’s price surge appear to be speculative buying and the influence of social media.

Memecoins, by their nature, thrive on community interest and viral trends, the so-called degen hype.

Heaven and hell in the cards

While the surge in PEPE’s price is impressive, it’s important to keep in mind the huge volatility of memecoins.

Investors have to understand whether this trend is sustainable or if it represents a short-term bubble, as the rapid price increase raises questions about potential market corrections.

Technical indicators are beginning to suggest that PEPE’s price might be due for a correction.

These indicators often serve as early warnings for investors about possible overvaluations and subsequent market adjustments, and for some, this literally says „time to sell”.

As the price of PEPE is going up, some investors might look to sell their holdings to realize profits, and this selling pressure can lead to significant price drops if it outweighs the buyers.

The market dynamics of memecoins are legendary, with prices capable of experiencing rapid and severe fluctuations, which often means remaining holders will have to carry the bag, potentially in big loss.

No one see what’s coming

The future of PEPE is unknown. The recent whale activity indicates strong confidence from big investors, yet the market, the average users must consider whether this confidence is justified by underlying value or driven only by speculative mania.

PEPE’s rise to the third-largest memecoin by market cap is a big deal because it highlights the powerful influence of social media and large investors in the cryptocurrency market, and it also prove the volatility and speculative nature of memecoins.