PayPal’s PYUSD stablecoin is rapidly nearing the $1 billion supply milestone, thanks in large part to its integration with the Solana blockchain.

The PYUSD is now among the top six stablecoins.

Supply explosion, but in a good way

If we take a look to the numbers, we can see that PYUSD’s supply increased by over $300 million, a 45% jump, just in the past month.

This makes PYUSD the fastest-growing stablecoin in the market, with its current supply is around $820 million.

The rise in PYUSD’s adoption is largely attributed to its expansion onto the Solana blockchain.

Initially launched on Ethereum in August last year, PYUSD experienced steady growth during its first 10 months. And then its adoption accelerated big time following its introduction to Solana in May this year.

Solana integration was a good move

The success of PYUSD on Solana is likely tied to the incentives offered by Solana-based DeFi protocols such as Kamino and Drift.

These platforms seducing users with valuable rewards, offering nearly 20% annual returns for holding the stablecoin.

While some in the market have raised concerns about the sustainability of such high yields, backing by the U.S. dollar could make it indeed stable.

Each PYUSD token is fully backed by an equivalent dollar in reserve, adding a layer of security for users.

When the new plan is better than the old plan

The high yields on Solana have been a deciding factor in shifting the balance of PYUSD away from Ethereum.

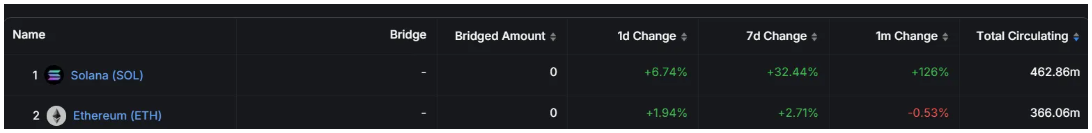

PYUSD holdings on Solana now exceed $462 million, surpassing the approximately $366 million held on Ethereum.

This makes PYUSD the third-largest stablecoin on Solana, trailing only Circle’s USDC and Tether’s USDT.

The rapid growth of PYUSD on Solana also led to increased adoption on major cryptocurrency exchanges too.

One of the biggest exchanges, Bybit now supports PYUSD deposits and withdrawals on the Solana network.