The NFT market’s colder than a January in Siberia, sales are tanking, and everyone’s whispering that the glory days are over.

But out of the blue, who comes back into the spotlight? OpenSea. The old boss is back, and it’s making noise like a Don at a family reunion.

Dominance

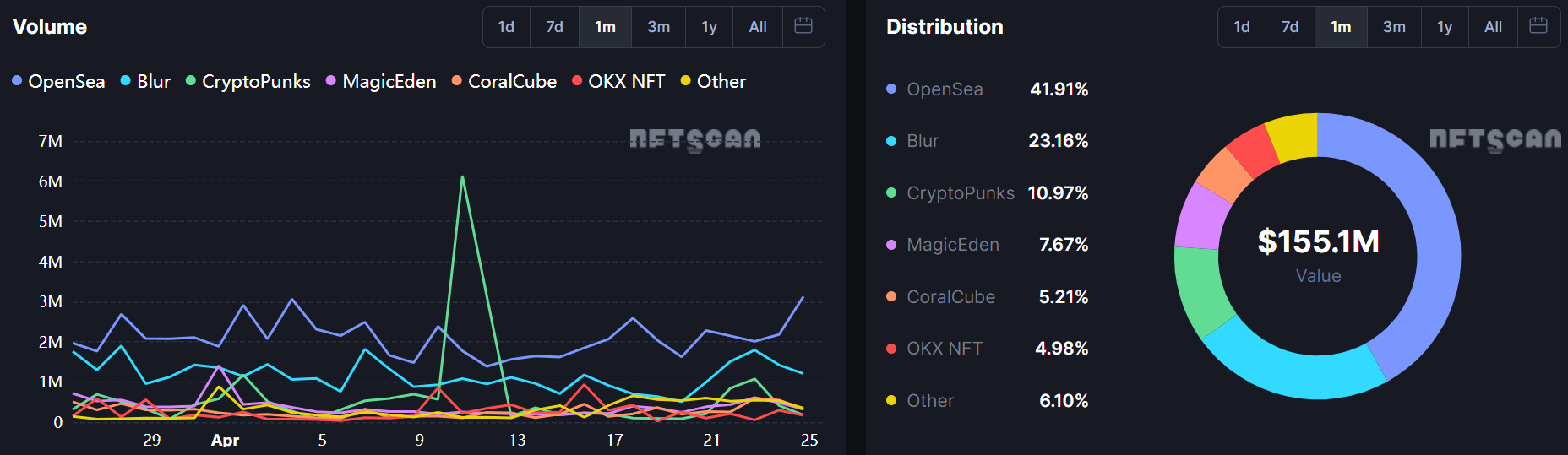

OpenSea just clawed its way back to the top, grabbing over 40% of all NFT trading volume in the last month. Blur, the so-called up-and-comer? Sitting at 23%. Nice and all, but just the second place.

Magic Eden and OKX? They’re picking up scraps with less than 8% and 5% respectively.

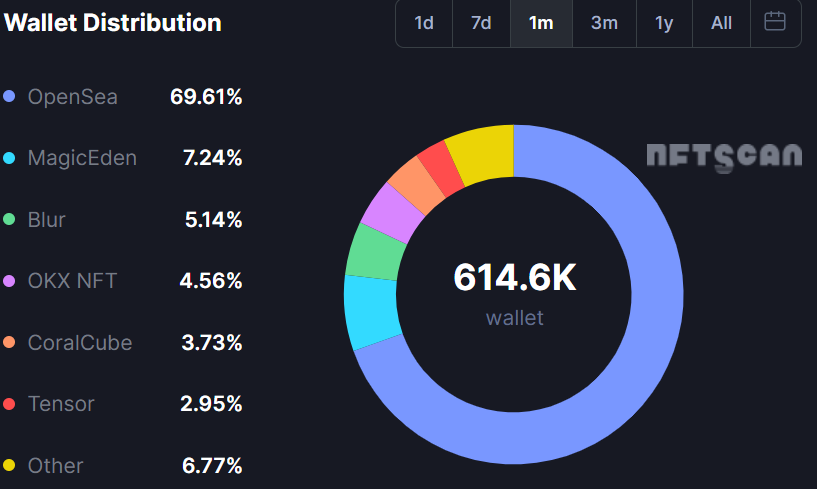

When it comes to active wallets, nearly 70% of NFT buyers are knocking on OpenSea’s door, over 610,000 wallets in a month, and more than 2.1 million in three months.

The competition? Combined, they barely scrape together 380,000 wallets over the same period.

So, what’s behind this comeback? First, OpenSea rolled out its shiny new OS2 platform. CEO Devin Finzer promised it would reimagine everything, and people are biting. There’s even talk of a native SEA token, because why not, right?

Throw in the fact that the SEC finally dropped its investigation, and suddenly OpenSea’s got the regulatory heat off its back.

Volume

But on the other hand, the NFT market’s still in a slump. Sales volume for Q1 2025? Down to $1.5 billion, a brutal 61% drop from the $4.1 billion we saw last year. Some big names are even shutting down shop.

GameStop, Bybit, gone. Projects like RTFKT’s CloneX are scrambling after Cloudflare pulled the plug on their content, leaving holders fuming and the devs promising to decentralize on Arweave.

Still, there’s a pulse. Over 359,000 people bought NFTs in the past week, a 52% jump from the week before. CryptoPunks, the OGs, saw sales spike 82%, raking in nearly $20 million in just 30 days.

And let’s not forget, Polygon NFTs even managed to outshine Ethereum for a hot minute, thanks to the Courtyard RWA collection.

$SEA is coming.

Here are a few things to know:

• Historical OpenSea usage, not just recent activity, will be an important ingredient

• Claim process will be simple and accessible. US users welcome

• We’re focused on long-term sustainability and supporting a healthy, enduring… pic.twitter.com/K8DsLZBROs— OpenSea Foundation (@openseafdn) February 13, 2025

Risk

But here’s the thing, it looks like OpenSea’s throne is built on shifting sand. The market’s crawling with scammers, phishing schemes, and even stolen NFTs.

OpenSea’s tried to clamp down with new policies and tech, but it’s a never-ending game of whack-a-mole.

Buyers and sellers still get burned, and sometimes the innocent get caught in the crossfire.

So OpenSea’s back on top, flexing like the Don it is. But in this business, you never know when the next hit is coming.

Have you read it yet? Trump’s meme token skyrockets 70% after VIP dinner invite

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.