The leading cryptocurrency exchange just announced they obtained a major license in Singapore, marking a big milestone for its operations.

Major Payment Institution license in the bag

OKX announced on Monday that it had been granted a Major Payment Institution, an MPI license by the MAS, the Monetary Authority of Singapore.

This license allows OKX to facilitate cross-border money transfers and offer digital payments, significantly expanding its service capabilities in Singapore.

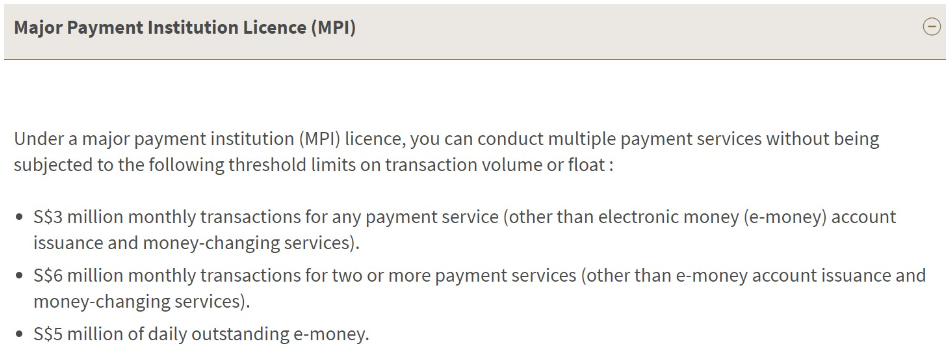

With the MPI license, OKX can now operate beyond the typical transaction limits imposed on payment institutions, handling more than 3 million Singaporean dollars (approximately $2.2 million) in payment services and exceeding a monthly limit of 6 million Singaporean dollars (around $4.4 million) across multiple services.

New operation, new leadership

In tandem with securing the license, OKX Singapore also appointed Gracie Lin as its new CEO.

Lin, who has an extensive background with the Monetary Authority of Singapore, brings a wealth of regulatory experience to her new role.

In a statement, Lin revealed the strategic importance of Singapore to OKX’s global plans, also noting the city-state’s reputation as a hub for digital assets.

She expressed that obtaining the MPI license is a key achievement for the progress, enabling OKX to boost customer access to digital payment tokens and cross-border transfers, including crypto spot trading.

We're taking crypto to the heart of financial markets and mainstream adoption: Singapore 🇸🇬

We've received our Major Payment Institution (MPI) License from the MAS, allowing us to offer digital payment tokens and cross-border money transfer services.

To lead our charter in… pic.twitter.com/33y3fXM4S4

— OKX (@okx) September 2, 2024

Business is booming where governments let it

Based on a new study by Henley & Partners, Singapore continues to lead the way in cryptocurrency adoption.

The study ranked Singapore first in the world for crypto adoption, citing the country’s strong financial infrastructure, favorable business environment, and progressive regulatory framework.

Singapore scored 45.7 out of the maximum 60 points, particularly excelling in economic factors and technology.

Following Singapore in the rankings were Hong Kong, a special administrative region of China, and the United Arab Emirates, both recognized for their business-friendly laws and environments.

Have you read it yet? Mastercard will replace credit card numbers with tokenization

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.