The world is seeing a rapid rise in crypto adoption, with 617 million people now holding digital assets.

There is a difference between total holders and monthly users, and this suggests that there’s a big potential to engage more people in the crypto space.

Crypto adoption, fueled by Solana

From the 617 million, only a fraction of them—around 60 million—use their crypto regularly, according to a new report from a16z. In September alone, 220 million crypto wallets interacted with blockchain, what is a sharp increase from the end of 2023.

Solana led the way, accounting for nearly 100 million active addresses. Other platforms also saw growth, with NEAR showing 31 million active addresses, Coinbase’s Base network reporting 22 million, and both Tron and Bitcoin logging 14 million and 11 million active addresses, respectively.

Ethereum-based chains were also important part of the action, with Binance’s BNB Chain seeing 10 million and Ethereum itself 6 million.

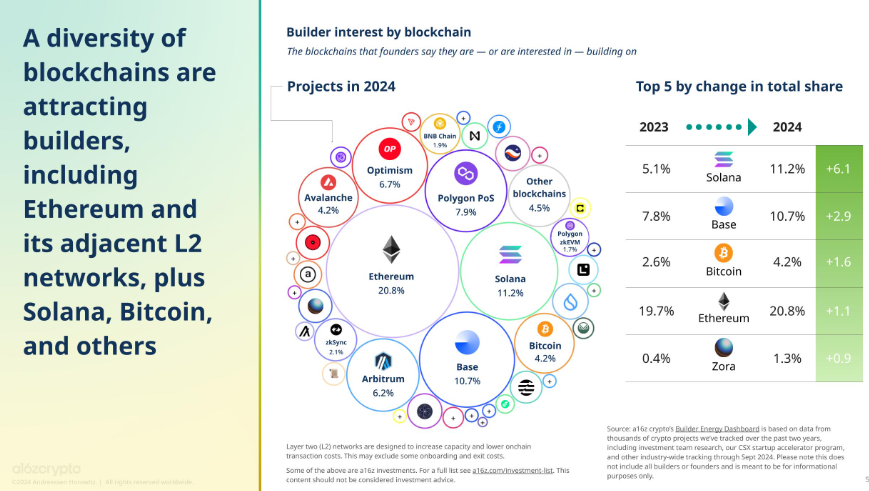

As interest in blockchain development continues to rise, Solana emerged as a leader.

Developer participation in Solana’s ecosystem jumped from 5.1% last year to 11.2% this year.

Other platforms, like Coinbase’s Base, also experienced a boost in developer interest, while Bitcoin saw a smaller but still important increase.

Despite these shifts, Ethereum remains the dominant player, with over 20% of all developers focusing on it.

U.S. losing share of mobile wallet users

The number of monthly mobile crypto wallet users also reached an all-time high of 29 million in June.

While the United States still leads with 12% of these users, its share is shrinking. This is due to increased adoption in other countries and some projects excluding U.S. users because of regulatory challenges.

Countries like Nigeria, India, and Argentina are seeing way faster crypto growth. Nigeria is working on regulatory clarity, launching initiatives that promote crypto for everyday uses like paying bills and shopping.

India, with its massive population and strong mobile usage, also became a key market for digital assets. In Argentina, economic instability has led many to adopt stablecoins as a way to safeguard their finances.

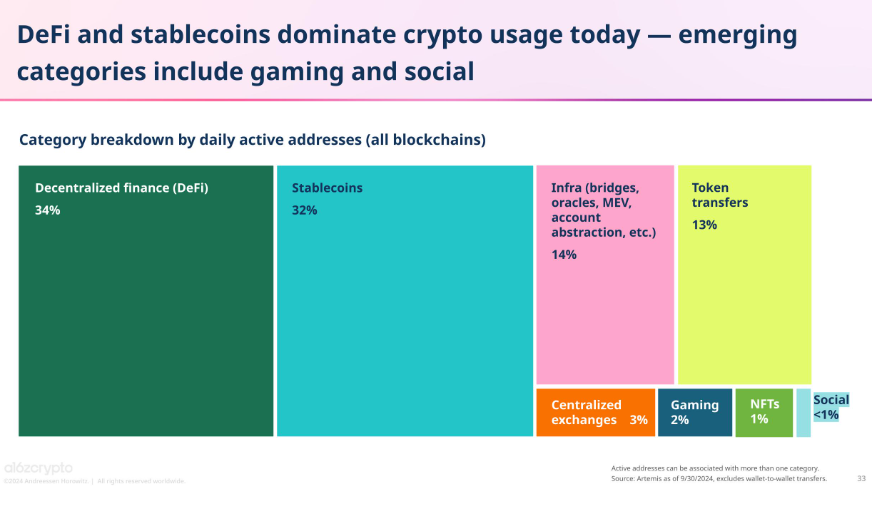

Stablecoins are the most popular crypto assets

Stablecoins are proving to be one of the most useful tools in the crypto world.

The a16z report reveals that stablecoins have processed an incredible $8.5 trillion in transactions across 1.1 billion transactions.

To put that in perspective, Visa handled less than a half, $3.9 trillion in the same period. Stablecoins are also helping to solidify the U.S. dollar’s global influence, with 99% of all stablecoins being dollar-denominated.