As the Market in Crypto Assets, the MiCA regulation nears implementation, Binance has halted copy trading services for its European users.

Big changes for Binancians

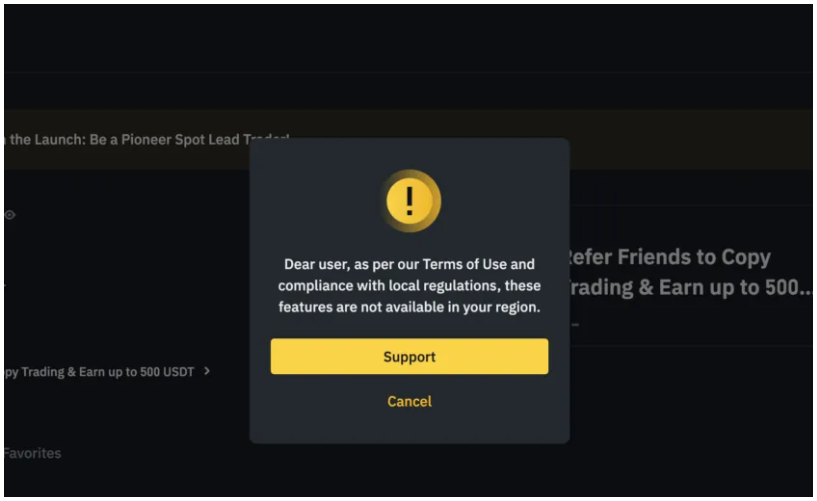

In the past days, European Binance users received notifications on their mobile apps stating that copy trading services are no longer available in their region.

Before this, Binance had alerted “Impacted Lead Traders and Copy Traders” among its users, and the exchange advised them to close their copy trading positions and transfer their funds back to their spot wallets by June 27.

They told them after the deadline, any remaining open positions will be automatically closed at market price, and assets will be moved to spot wallets.

Tighter control, less free choice

This change align with Binance’s announcement on June 21 about unapproved stablecoins in the EU. Starting June 30, users won’t be able to trade, deposit, or withdraw stablecoins that don’t comply with MiCA guidelines.

The stablecoins not authorized under MiCA, such as USDT, the most popular one in the market, will remain available for trading, deposits, withdrawals, and in user wallets.

Binance also altered its rewards and referral systems, so now, spot and margin trading referral commissions will be paid in BNB, Binance’s own token, instead of stablecoins.

The exchange has advised its European users to review their holdings and consider switch to regulated stablecoins or other digital assets before June 30.

Political regulation

Introduced in 2023, MiCA is the first clear regulation for crypto assets in the EU, cheered for providing legal clarity for stakeholders.

It categorizes the types of digital assets, specifies the laws, and enforcement. Additionally, they say it protects investors, prevents fraud, and comply with anti-money laundering and financial laws.

Industry experts, like Ilya Volkov, CEO of the crypto platform YouHodler, thinks despite the challenges posed by the new regulation on stablecoins, the Web3 and crypto platforms should migrate from non-compliant stablecoins to those meeting MiCA standards.

He also thinks MiCA sets a precedent for international crypto regulation, serving as a model for other regions, and because of this, chances are high that countries in Latin America and Asia can adopt similar approaches in the future.