The Nigerian Government, through its Minister of Information, Mohammed Idris, has firmly defended the ongoing trial of Binance executive Tigran Gambaryan.

Amid increasing international pressure to release Gambaryan, Idris insists that the legal proceedings are being conducted in full accordance with Nigerian law.

He emphasized that due process has been meticulously followed, and prosecutors are confident in their case based on the evidence collected. The next court hearing is set for June 20, 2024.

International Pressure Mounts

The trial has sparked significant international backlash, with accusations that the Nigerian government is using Gambaryan as a pawn to pressure Binance into negotiations.

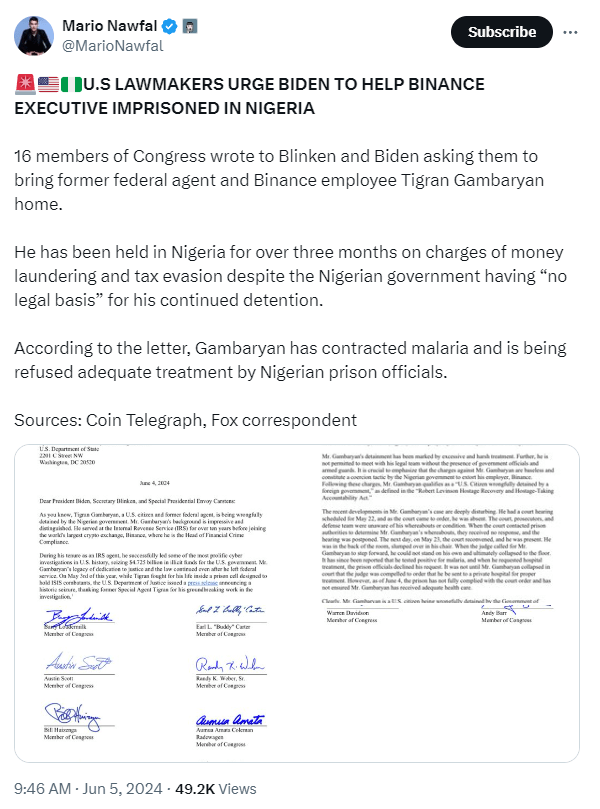

This sentiment is echoed by 12 U.S. lawmakers who have taken the matter to President Biden.

They have urged him to transfer Gambaryan’s case to the Special President Envoy for Hostage Affairs, underscoring the severity of the situation.

The lawmakers argue that Gambaryan is being held hostage, which they believe is a tactic to leverage Binance into settling disputes.

Bail Denied, Health Concerns Rise

Adding to the controversy, Nigerian courts have denied bail for Gambaryan, citing a high risk of flight.

This decision was influenced by the earlier escape of Gambaryan’s associate, Naadem Anjarwalla, who fled to Kenya.

With heightened security measures now in place, Gambaryan remains in custody under strict conditions.

Gambaryan’s health has also become a major concern. He collapsed during a recent court hearing, raising alarms about his well-being. U.S. lawmakers have expressed deep concern over his deteriorating health, stating that immediate action is necessary to ensure his safety and preserve his life.

They stressed the urgency of the situation, calling for swift intervention before it is too late.

Economic Implications

The Nigerian government has placed part of the blame for the country’s economic challenges on Binance, particularly highlighting the sharp decline in the value of the Naira over the past year.

Reports suggest that Nigeria is seeking a hefty $10 billion fine from Binance amid claims of financial extortion.

This situation reflects broader economic tensions and the government’s attempts to address financial instability within the country.

What’s at Stake?

The stakes in this case are high, not just for Tigran Gambaryan but also for Binance and the broader cryptocurrency market.

The outcome of this trial could set significant precedents for how international financial disputes and corporate accountability are handled in the cryptocurrency industry.

Conclusion

In conclusion, the Nigerian government’s defense of the trial of Binance executive Tigran Gambaryan amid mounting international pressure highlights the complex interplay between legal proceedings, international diplomacy, and economic interests.

As the trial progresses, all eyes will be on Nigeria to see how it navigates this high-stakes situation.

The upcoming hearing on June 20, 2024, will be a crucial moment in this unfolding saga.

For now, the world waits to see whether diplomatic efforts and legal arguments will converge to resolve this contentious case.