NFT sales have taken a serious hit, reaching their lowest monthly volume since 2021.

In September, the number of NFT transactions dropped by 32%, falling from 7.3 million in August to just 4.9 million.

No one cares about NFTs anymore?

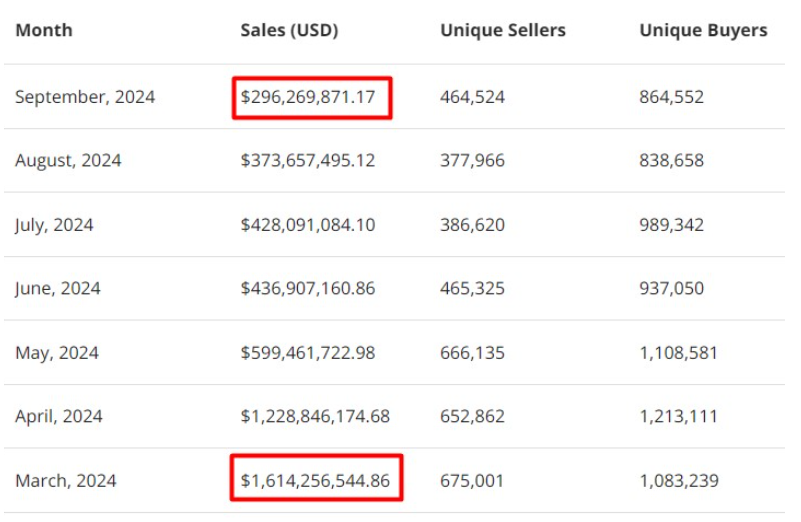

CryptoSlam’s data shows that NFT sales totaled $296 million in September, marking a 20% decline from August’s sales of $373 million.

This figure is 81% drop from the $1.6 billion in sales recorded in March, which was the strongest month for digital collectibles in this year.

The last time monthly sales volume dipped below $300 million was in January 2021 when it fell to $109 million.

Despite the drop in sales volume, the average value of NFT transactions increased by 18%, rising from $50.71 in August to $60 in September.

Regulatory drama

The bad news is that United States SEC is focusing on NFTs. On August 28, Devin Finzer, CEO of NFT marketplace OpenSea revealed that the company received a Wells notice from the SEC.

This notice indicated that the SEC believes some NFTs on OpenSea may be considered unregistered securities.

On September 16, the SEC fined Flyfish Club, an NFT-themed restaurant, $750,000 for selling NFTs, but SEC commissioners Hester Peirce and Mark Uyeda expressed their disagreement with this enforcement action, arguing that the NFTs sold by Flyfish shouldn’t fall under securities laws because they were simply a different way to sell memberships.

SEC often doesn’t looks like the white knight for customer protection, but like a goon

Luca Schnetzler, CEO of the popular NFT collection Pudgy Penguins, dismissed the SEC’s actions as nonsense.

Schnetzler described the SEC’s focus on OpenSea as a “nothing burger,” suggesting that if the agency targets OpenSea, it should also consider larger companies involved in NFTs like Sotheby’s, Nike, and Pokemon.

One thing is sure, if this trend continues and regulatory scrutiny increases, it could lead to more pain for the NFT market. For our safety, of course.