Ethereum has seen a big surge following the U.S. SEC approval of several spot Ethereum ETFs.

In the past days the price of ETH climbed to $3,980 per coin, which is roughly 18.4% below its all-time high.

The cavalry is here!

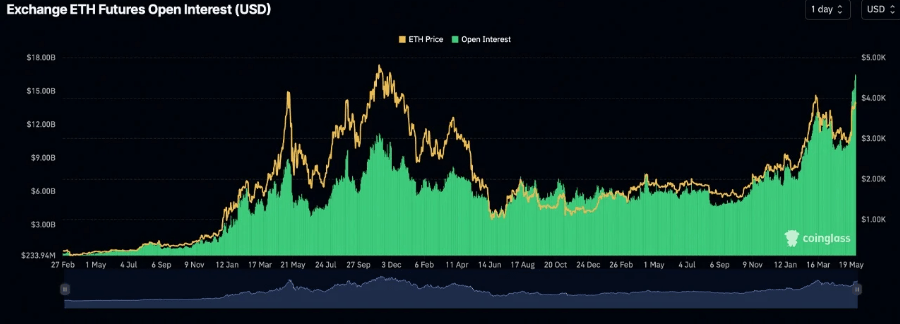

As Ethereum spot markets is maybe more active than ever, the demand for Ethereum derivatives has also grown big time.

The open interest in Ethereum futures has reached record levels, and simultaneously, the combined open interest in Ethereum options is near its historical all-time-high.

As of May 28, 2024, the total open interest in Ethereum futures stands at approximately $17.05 billion.

High open interest in Ethereum futures and options generally signals increased trading activity and growing interest from both institutional and retail investors.

This high Ethereum open interest can lead to greater price volatility as traders adjust their positions, indicating a significant price movement on the horizon.

The combined open interest in Ethereum options contracts is $10.99 billion.

Cause and effect on the Ethereum markets

In the futures market, Binance leads with $6.14 billion of the $17.05 billion in open interest, followed by Bybit with $3.48 billion and Okx with $2.18 billion.

In the options market, Deribit dominates with $9.77 billion of the $10.99 billion total, followed by Okx, Binance, and Delta Exchange.

In spot markets, ETH has seen a 33.3% increase over the past two weeks, while 30-day statistics reflect a 16.9% gain.

Although ETH recently approached its all-time high, it is still 20.9% below the peak of $4,878 per unit reached on November 10, 2021.

The rise in Ethereum’s price, driven by the approval of spot Ethereum ETFs, has visibly impacted not only the spot markets but also the derivatives segment.

Mission accomplished?

The introduction of cryptocurrency ETFs is a huge milestone, a big development as it allows traditional investors and institutions to enter the crypto market.

This influx of institutional investment can lead to increased liquidity and market stability, but it also brings potential challenges, such as higher than usual volatility due to large-scale trading and the need for robust regulatory frameworks to handle the risks associated with increased participation.