The memecoin scene is all hype again, and it looks like there are some fresh faces.

Risk-loving investors are eager to jump on board, but here is the question, are the OG memecoins losing their charm?

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The memecoin market shake-up

This year has seen a flood of new tokens flooding the market, each promising quick profits, as since the launch of Dogecoin in 2013, the number of memecoins has exploded, often backed by celebrity endorsements and viral memes.

But while everyone seems ready to dive in, the real heavyweights, the whales, are still calling the shots.

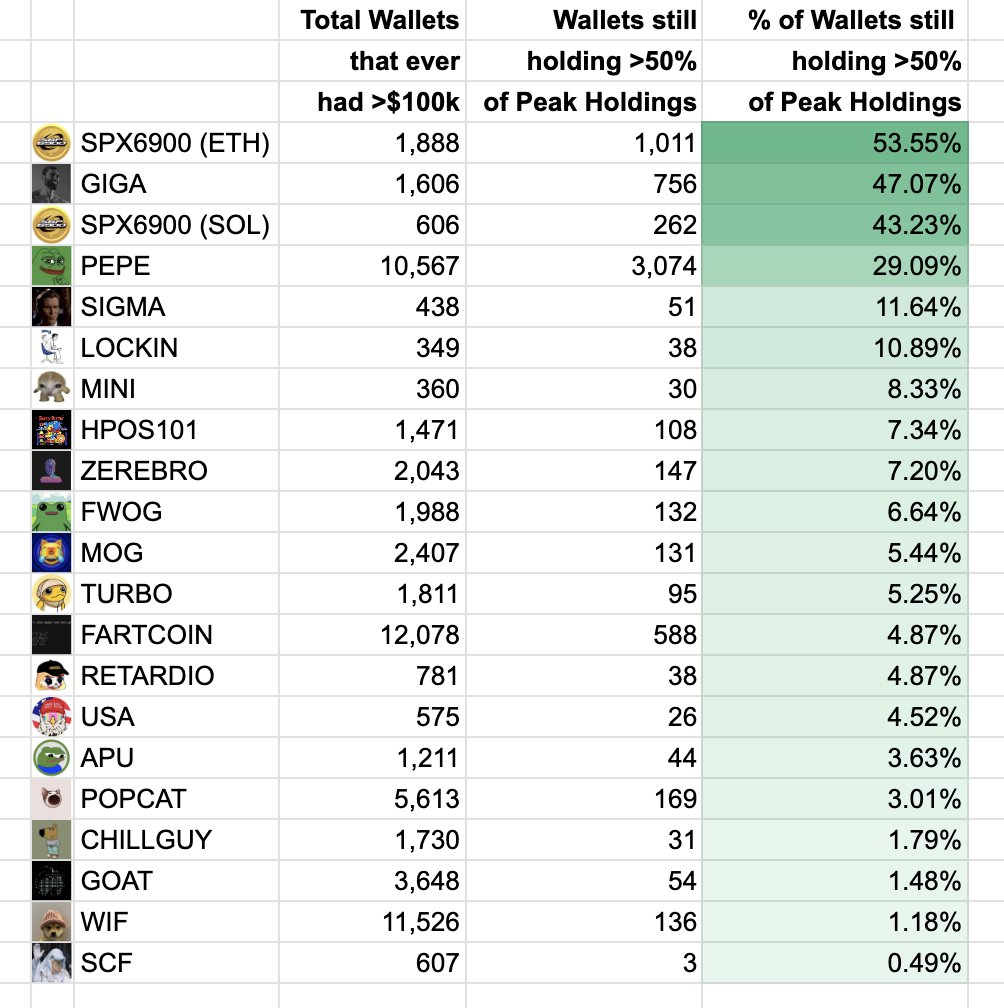

For older memecoins, fewer wallets are holding a significant chunk of tokens. For example, only 1.18% of wallets hold over $50K worth of Dogwifhat, while 53.55% of wallets for SPX6900 are stacked with $50K or more.

What’s more interesting is that these newer coins offer more than just a catchy name, they’re shaking up the entire market with virality, big exchange listings, and massive media presence.

Whale rule

Whales are taking a more tactical approach these days, pouring money into new tokens with strong celebrity backing or unique features.

This strategy not only boosts their market value but also creates that all-important hype that gets everyone cheering.

So, should we be waving goodbye to the classic memecoins? It’s a valid question. The top five OG memecoins are still struggling to reach their much-anticipated targets.

For example, DOGE hasn’t even managed to break the $1 level yet!

Newer contenders like FARTCOIN have skyrocketed by an astounding 1900%, crossing $1 just three months after launching, but fair to say, with a relatively smaller supply, compared to Dogecoin’s.

What’s behind the shift? The new is better?

The difference lies in tokenomics. Newer memecoins are capitalizing on what older ones lack, for example strong economic fundamentals.

While SHIB has a supply of 589.25 trillion coins, FARTCOIN caps its total supply at just 1 billion.

When you combine lower supply with higher demand, you’ve got a recipe for price growth, something these newcomers are definitely enjoying.

Smaller liquidity means more volatility, thus, bigger gains. Also, bigger dips and crashes too!

As whales continue to accumulate older coins, their price impact seems flat compared to these fresh players.

It’s clear that savvy investors are starting to prefer short-term gains from these new tokens over sticking with the classics. Or may we call them degens?