Bitcoin reached a peak of $64,000 in this week, before dropping back to below $62,000, raising questions about whether the price can achieve new highs soon.

Bitcoin at a key psychological crossroads

A CryptoQuant analyst shared their insights on what could help Bitcoin maintain its current price range and possibly reach higher levels.

Historically, market participants tend to feel negative when their Bitcoin holdings lose value after a sharp decline.

The analyst pointed out that Bitcoin is currently at a critical psychological turning point, a phase where the mindset of market participants can influence Bitcoin’s price movement big time.

Price stability

The analyst emphasized that for Bitcoin to stay in this optimistic zone, it’s important to maintain stability in these levels.

They noted that the Supply in Profit metric shows that optimism tends to rise when a large portion of the supply is profitable. Now Bitcoin is testing this optimistic zone.

In previous market cycles, Bitcoin has remained steady between these two psychological zones, which led to ongoing price increases.

CryptoQuant experts believe that as long as Bitcoin stays within this optimistic area, its price could rise to new local highs.

Challenges for Bitcoin

While many Bitcoin supporters are hopeful for a bullish trend in the market, there are reasons to be cautious about its expected growth.

There are discussions about the U.S. government selling 69,370 BTC, valued at around $4.3 billion, which was seized from the Silk Road darkweb marketplace.

If this sale goes through, it could lead to a quite bearish trend in the Bitcoin market, similar to what happened earlier this year when Germany sold its BTC holdings.

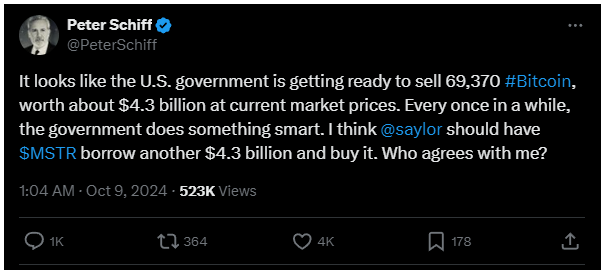

American economist and well-known goldbug Peter Schiff suggested that MicroStrategy’s Michael Saylor should step in to buy the government’s Bitcoin stash in order to prevent a severe drop in prices. And this isn’t a bad idea at all!